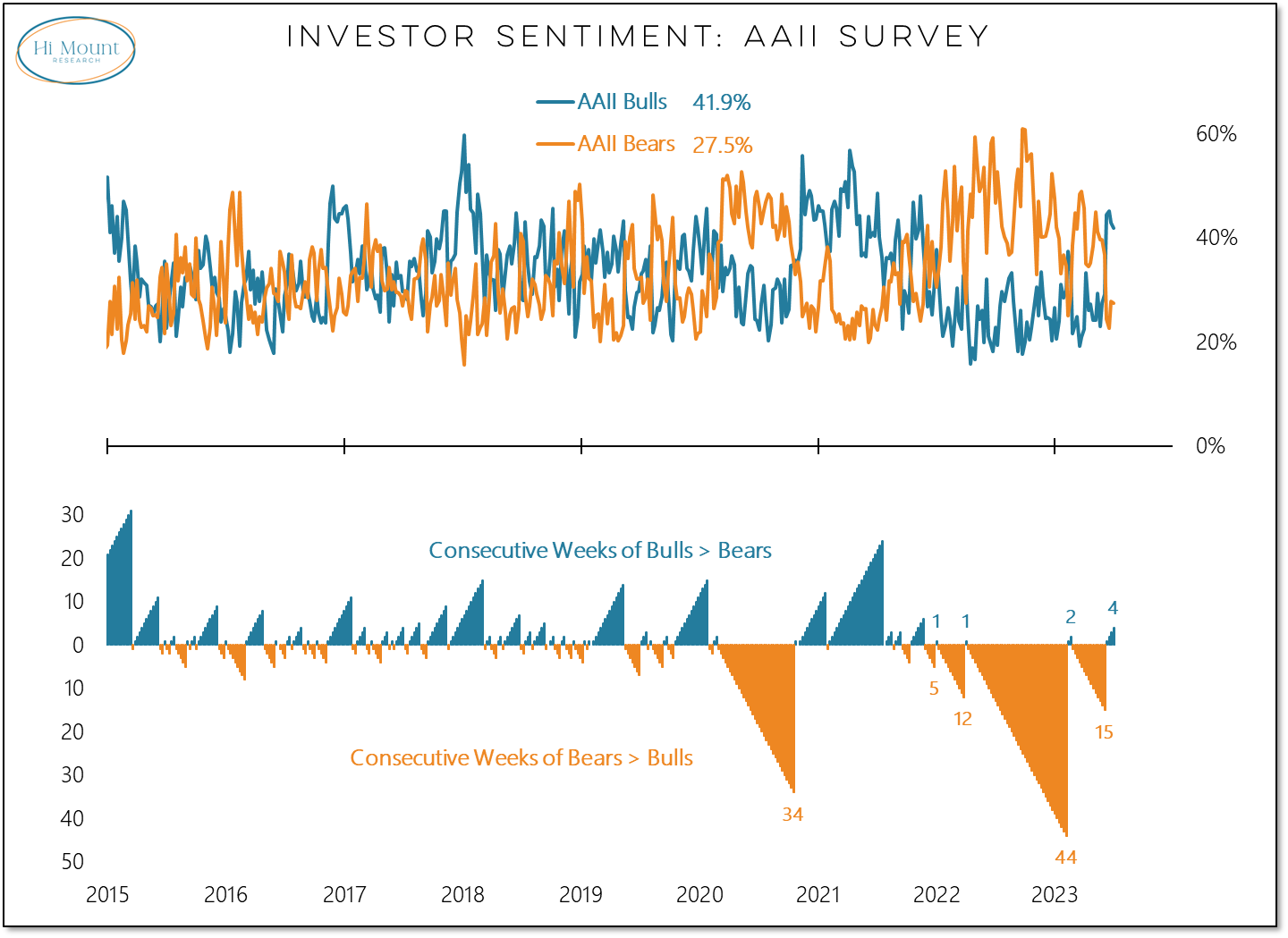

Key Takeaway: Shifts from pessimism to optimism are typically bullish for stocks, but bulls and bears are currently in no-man’s land for stocks.

More Detail: June produced more weeks with bulls greater than bears than the previous 18 months combined. The seven previous times optimism re-emerged after periods of sustained pessimism (bears > bulls more than 50% of the time over the previous year), stocks were up an average of 13% over the 6 months following peak pessimism and 20% over the 12 months following peak pessimism. With the accelerated emergence of optimism in recent weeks, continued strength from stocks would not be surprising.

While the sentiment shift is encouraging, current levels are not. Bulls are at 42% this week and bears are at 28%. Going back to 1987, we have seen the combination of Bulls in the 40s and Bears in the 20s roughly 15% of the time. During such periods, the S&P 500 has struggled to keep its head above water. Bullish arguments would be enhanced if this survey were showing either more optimism or more pessimism rather than the currently tepid mix of bulls and bears.

This week’s Three For Thursday Video update (Heading Toward H2) is available to subscribers.

Our latest special report (Secular Headwinds Argue for Dynamic Exposure) is available for everyone.