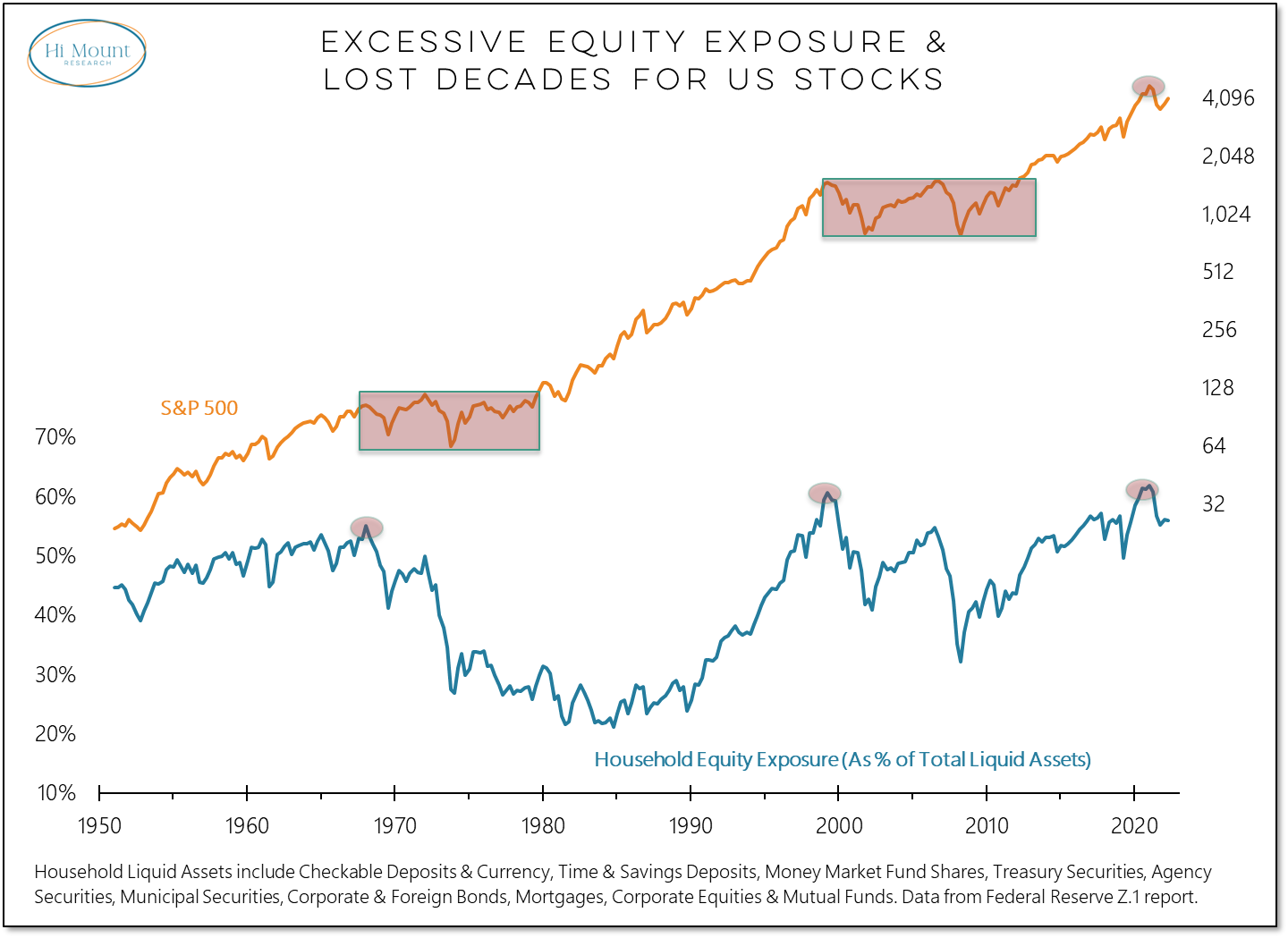

Key Takeaway: The secular environment has shifted from strength to headwind. Dynamic asset allocation approaches can help investors weather the associated equity market churn.

More Detail: Household equity exposure peaked (at a new all-time high) in Q4 2021 and has since pulled back. Similar peaks in the late 60’s and late 90’s were followed by lost decades for stocks. The S&P 500 moved sideways in a broad range from Q4 1968 through Q1 1980 and Q1 2000 through Q4 2012.

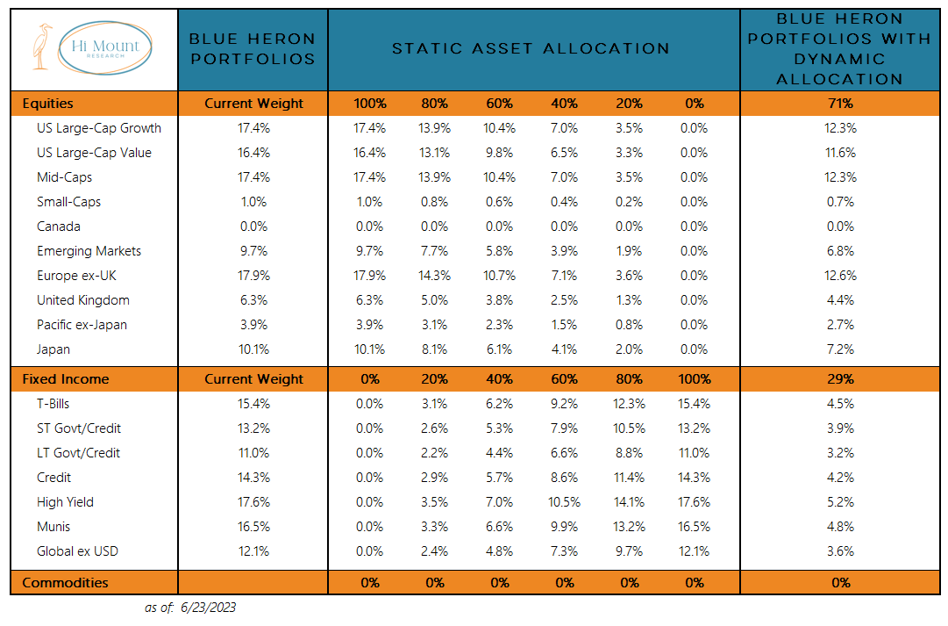

For investors with static exposure, the churn associated with such headwinds can grind on nerves. The risks associated with historically high equity exposure can grind on returns. Dynamic exposure helps investors adapt to the reality of the environment and remain in harmony with the underlying trends. This applies across asset classes and within asset classes.

Go Deeper: For more context on the secular environment across asset classes, download the entire report.