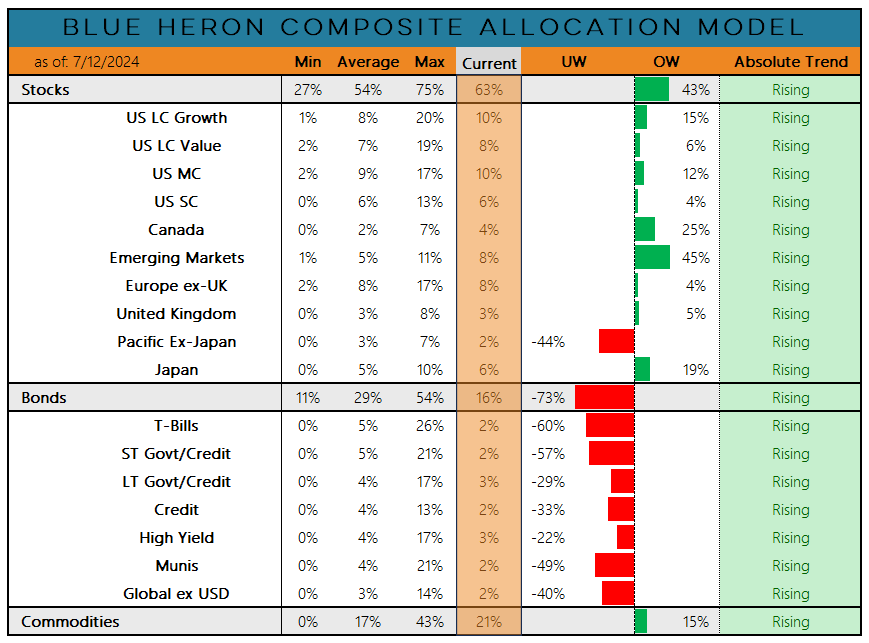

Key Takeaway: Bond yields may have peaked for the cycle, but our asset allocation model still favors stocks > commodities > bonds.

The bond market is again banking on a Fed pivot (by our reckoning, the seventh expected turn of this cycle). While a cyclical peak on yields may very well be in place, the longer-term trend environment for bond yields has decisively shifted. After a generation of lower highs on the 10-year T-Note yield, the new reality is one of higher highs. A break above 5% seems more likely than a sustained drop below 3.25%.

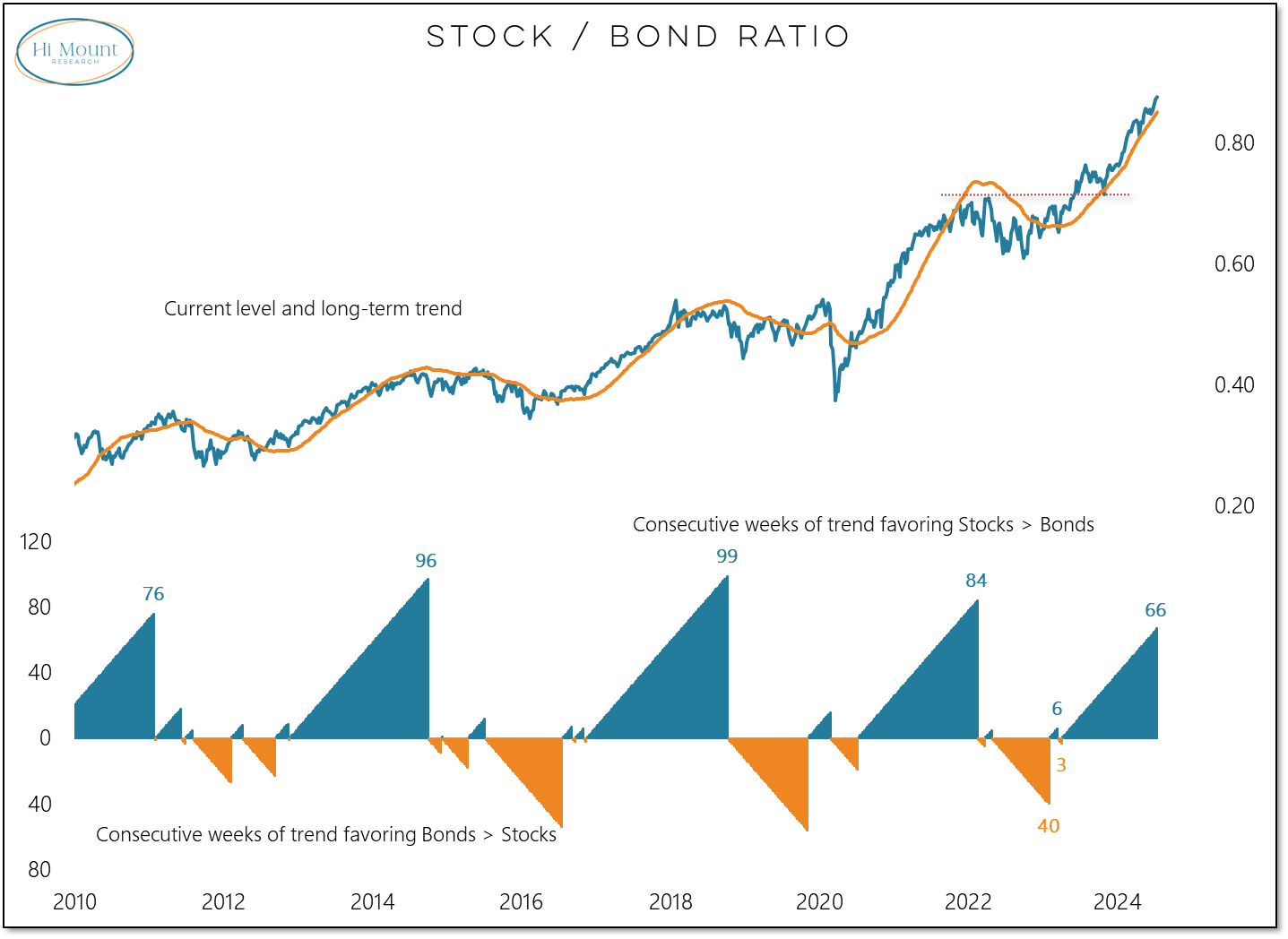

While yields may have peaked, bonds have not stopped going down relative to stocks. The stock/bond ratio made another new high last week. From a trend following perspective, this is not the time to shift exposure from stocks to bonds.

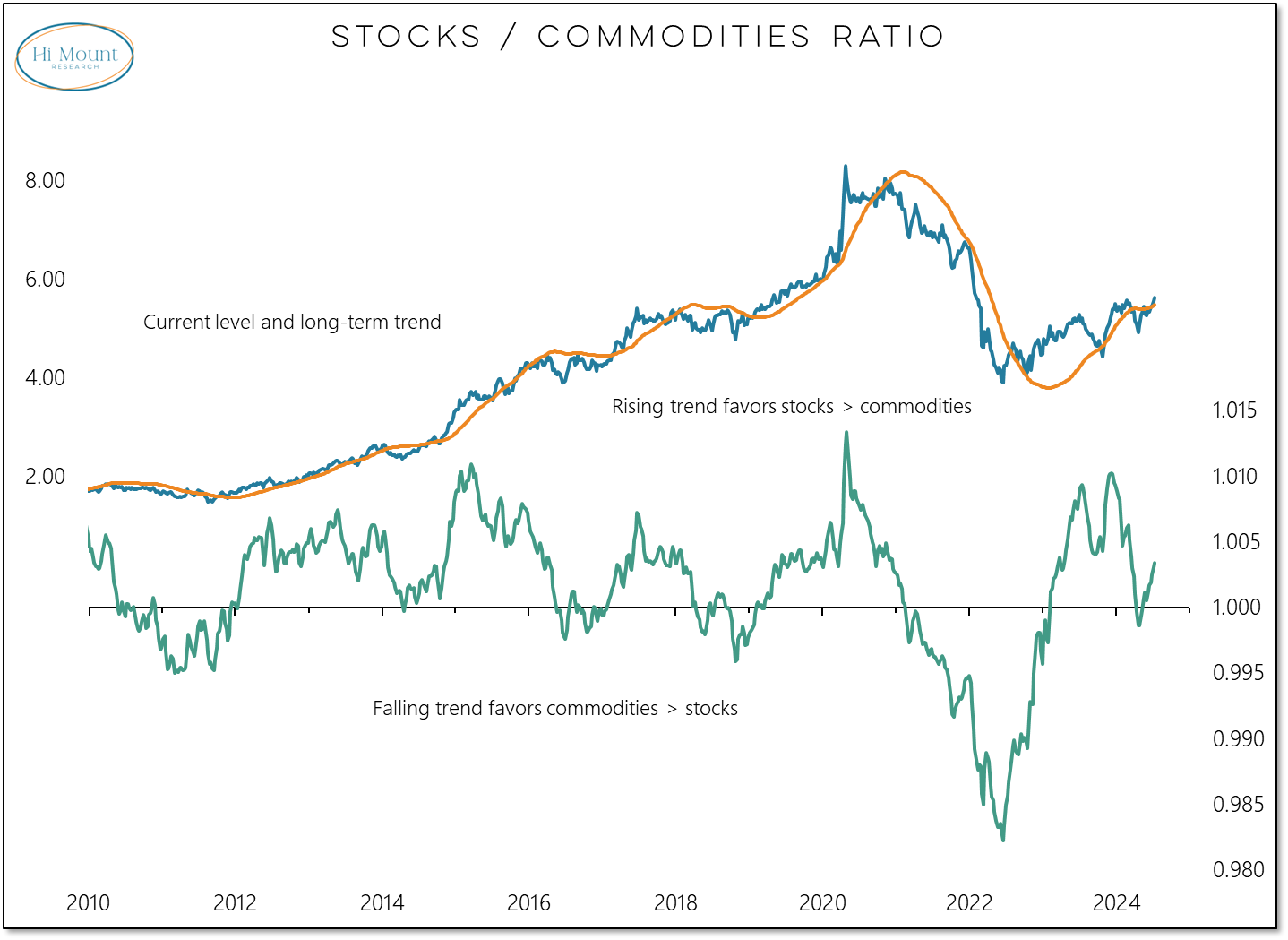

Stocks are also breaking out to new cycle highs versus commodities.

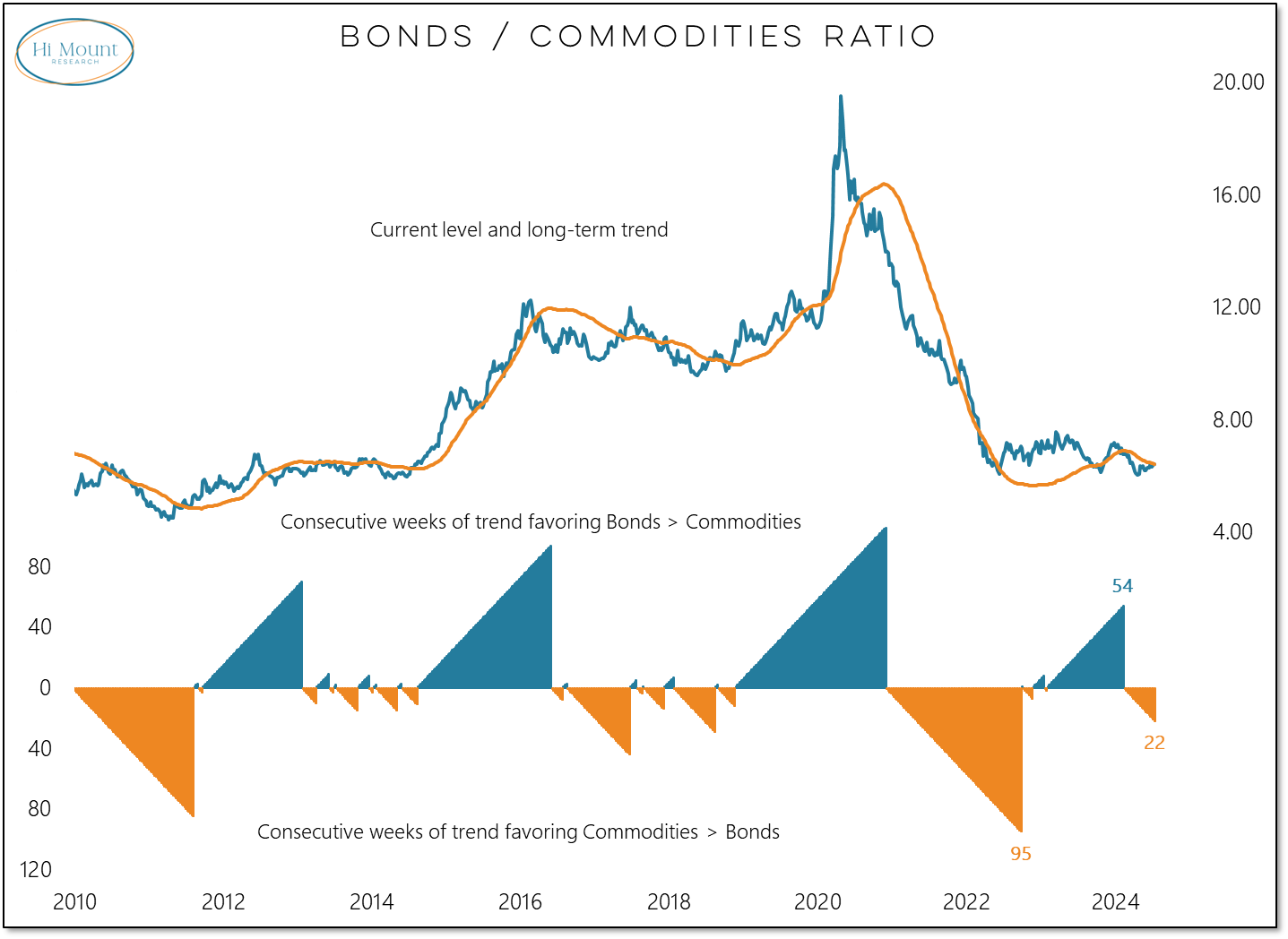

Commodities are still holding on to their edge over bonds.

Absolute trends are rising across the board, but the relative trends have our composite asset allocation model overweight equities (and to a lesser extent commodities) and underweight bonds. When the environment shifts, the model’s allocation will adapt.