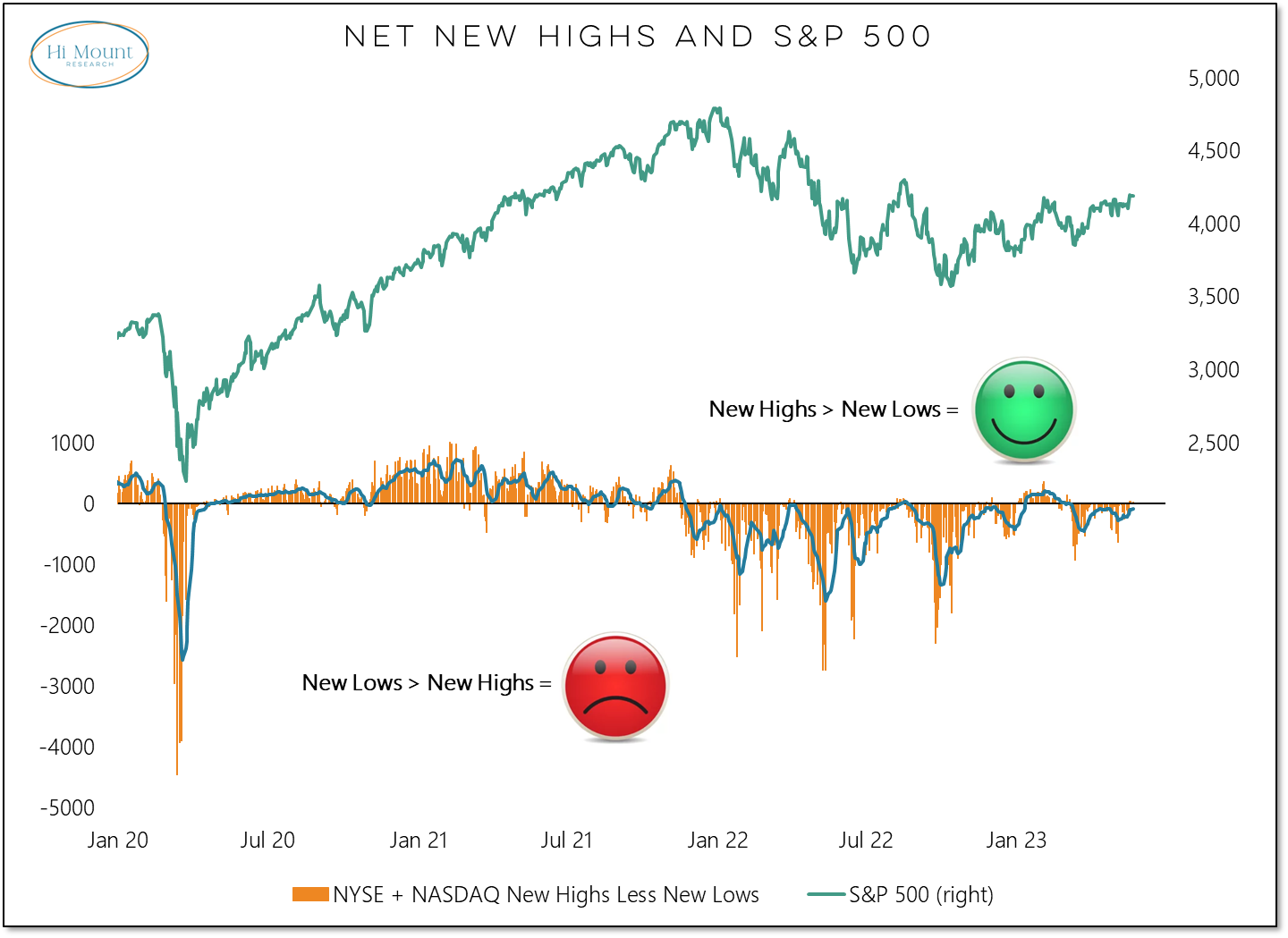

Key Takeaway: New highs exceeding new lows in recent days is an encouraging development. Doing so on a consistent basis would suggest that last year’s bear market is receding into history.

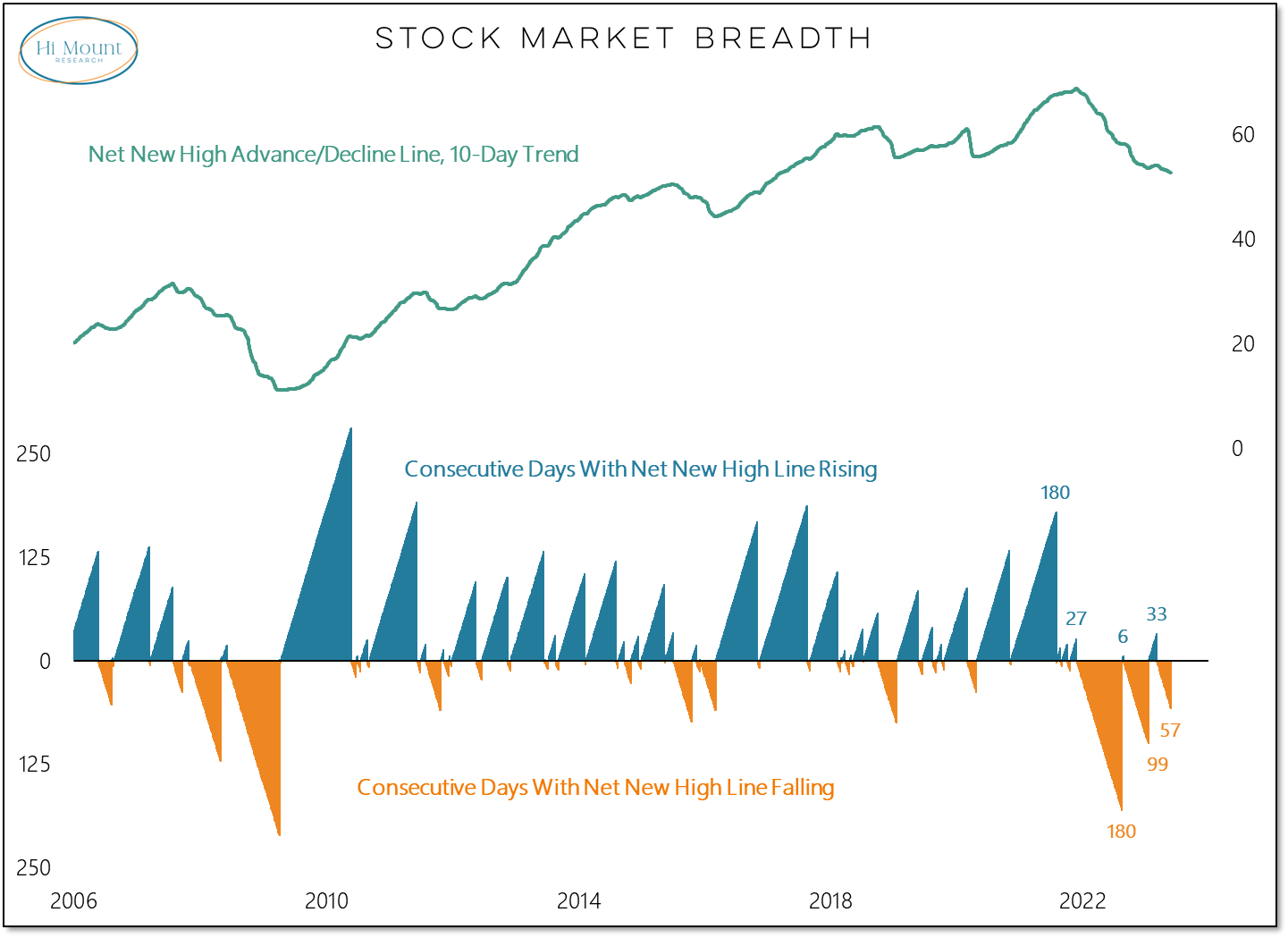

For now, the trend in net new highs remains lower. The trend has fallen for 57 days in a row and going back to November 2021, it has been lower 90% of the time (336 of 375 trading days).

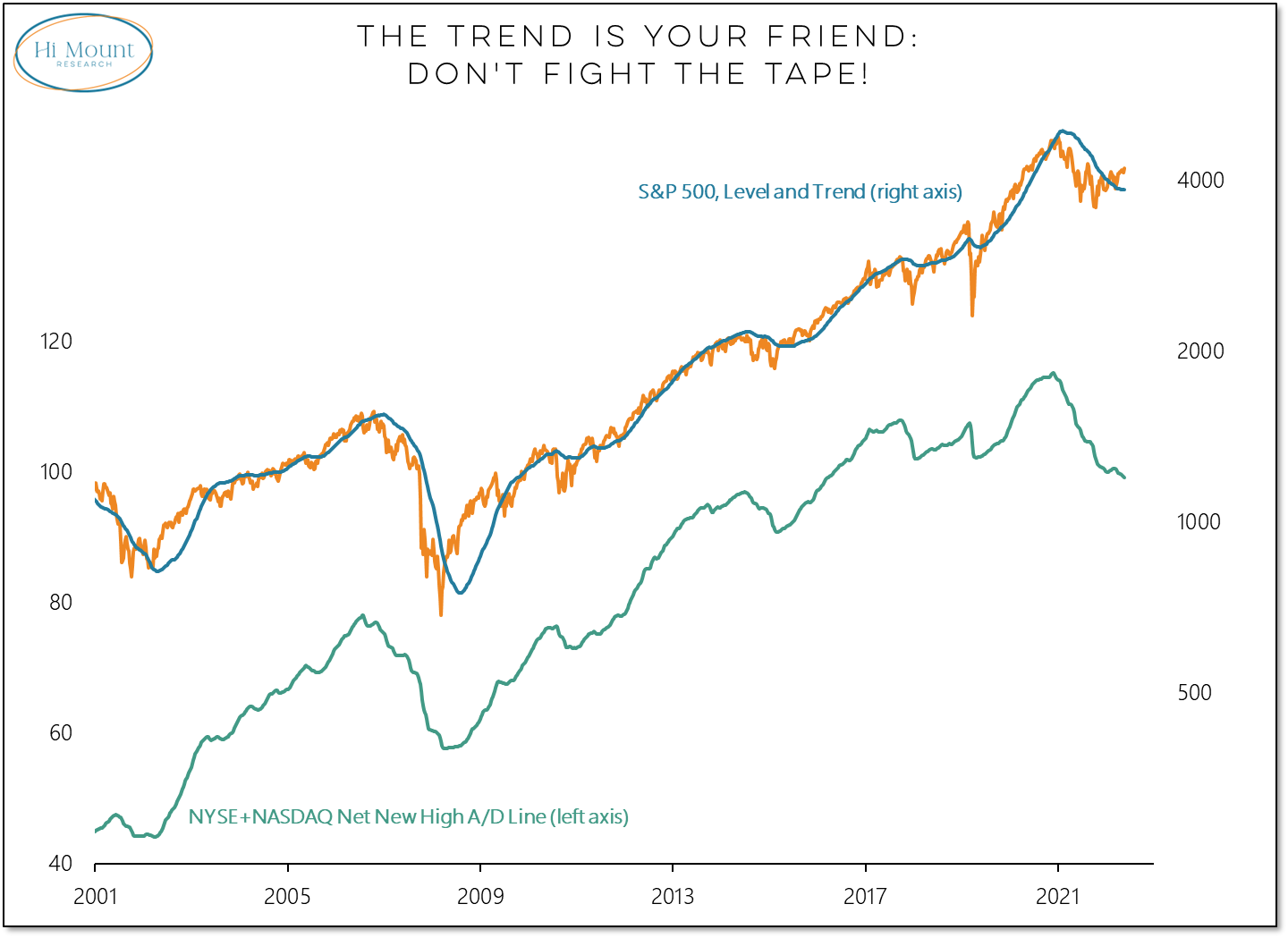

History suggests that attempts by the S&P 500 to carve out a sustainable low are unlikely to succeed as long as more stocks are making new lows than new highs. The corollary is that if the trend in net new highs can turn higher, breadth would become a bullish tailwind. “Don’t fight the tape” is a mantra that works both ways.

We are seeing some evidence of bull market behavior, but so far it has been limited to the trend indicators that are beneficiaries of mega-cap strength. Those dependent on broader strength have struggled to turn (or stay) positive.