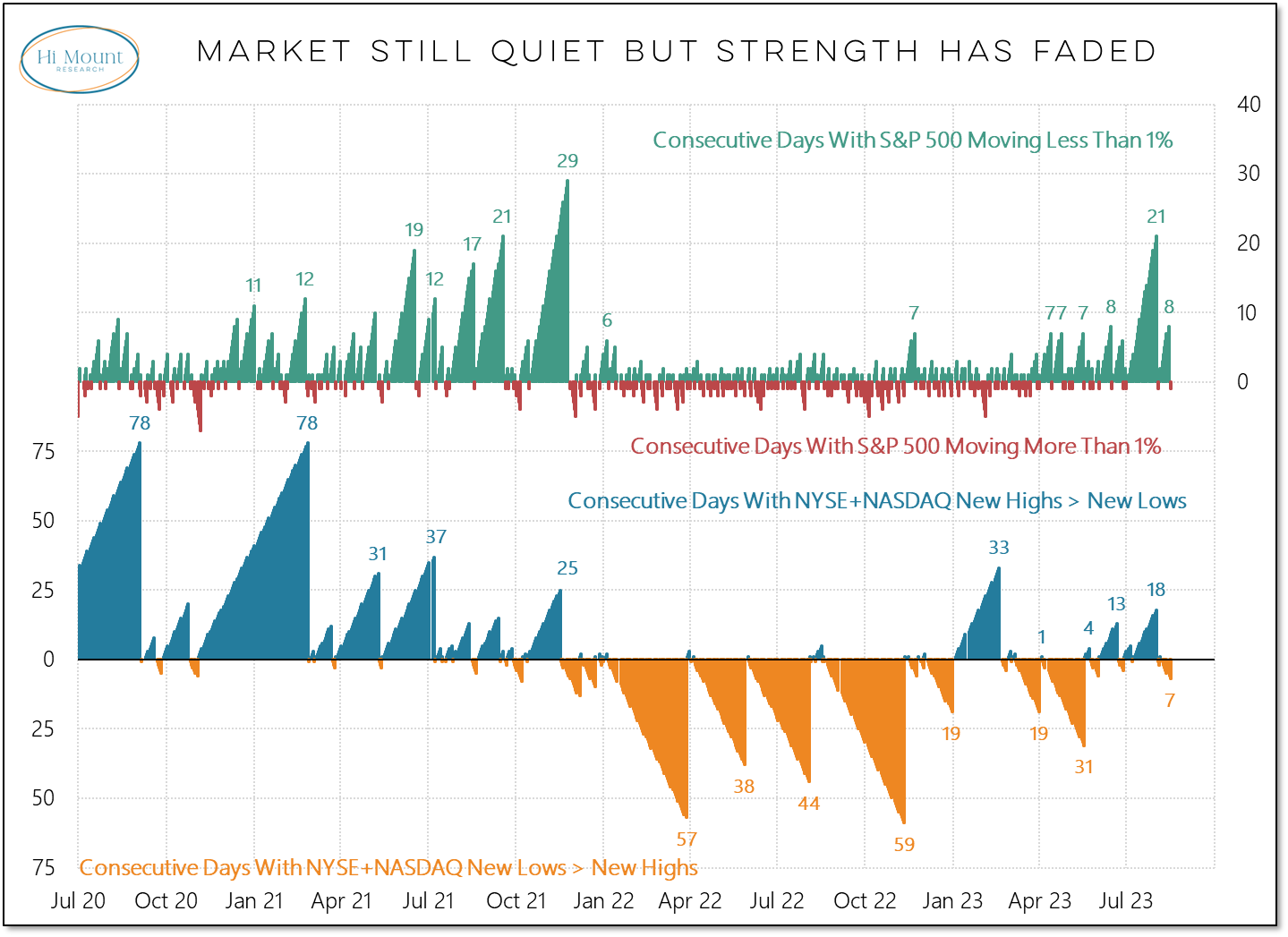

Key Takeaway: Today was only the third 1% daily swing in the S&P 500 in the past two months. But it was also the seventh day in a row with more new lows than new highs. After strength faded last week, the market is getting less quiet this week.

We don’t want to get distracted by a single day’s action, but also don’t want to summarily dismiss any single day in the market. For now, the absence of fear (e.g. VIX > 28.5) suggests the path of least resistance for stocks is lower. Bulls no doubt have drawn their lines in the sand and will be under pressure to defend them.

In this week’s Market Notes we update the Bull Market Behavior Checklist and our “Fear or Strength” Model, while the Weekly Chart Pack goes deeper into the breadth deterioration and what we are seeing from the bond market.