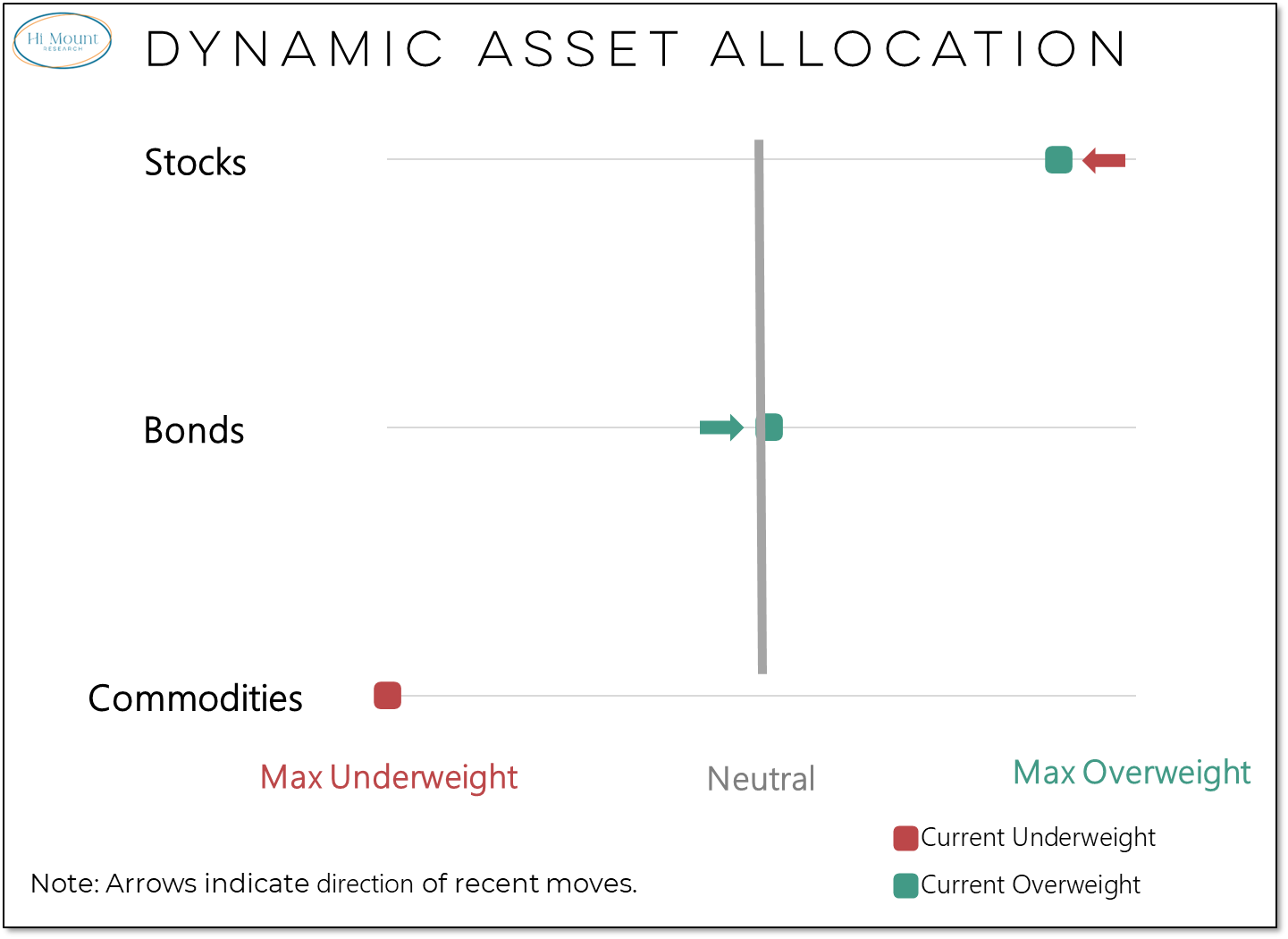

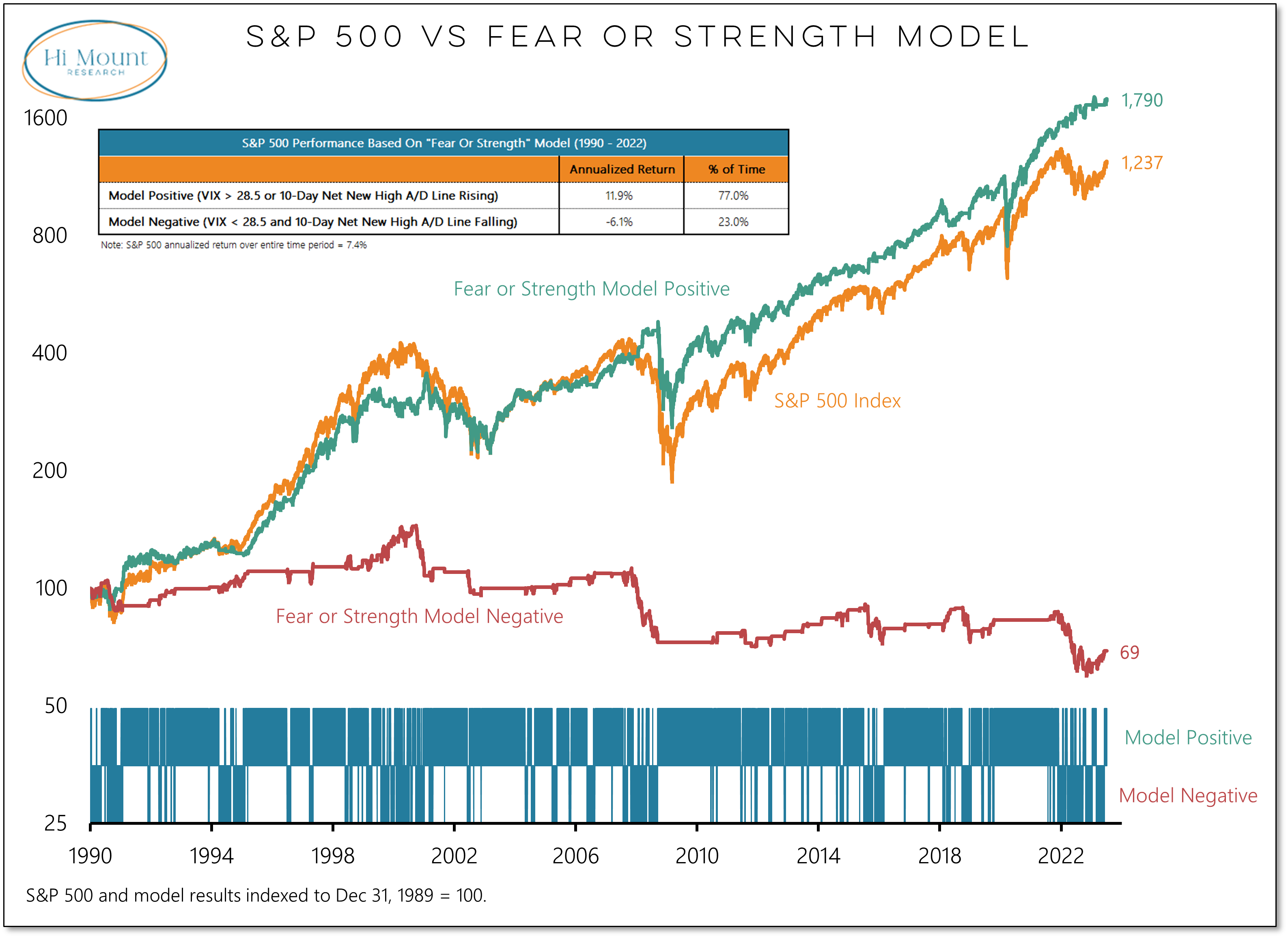

Discretionary Portfolios: While price and breadth trends are bullish, the overall weight of the evidence continues to argue for caution. In the context of our Dynamic Portfolios this means keeping equity exposure in the Strategic and Cyclical portfolios still below benchmark. But with our Fear or Strength Model remaining positive, we continue to put cash to work on a tactical basis.

Systematic Portfolios: Our Blue Heron Portfolios stay in harmony with absolute and relative price trends shown in our Asset Allocation model. From a Fixed Income perspective this means avoiding long-term Treasuries, while from an Equity perspective the model has embraced recent improvements in mid-caps and small-caps. On a composite basis, this portfolio is overweight equities, neutral bonds, and avoiding commodities.