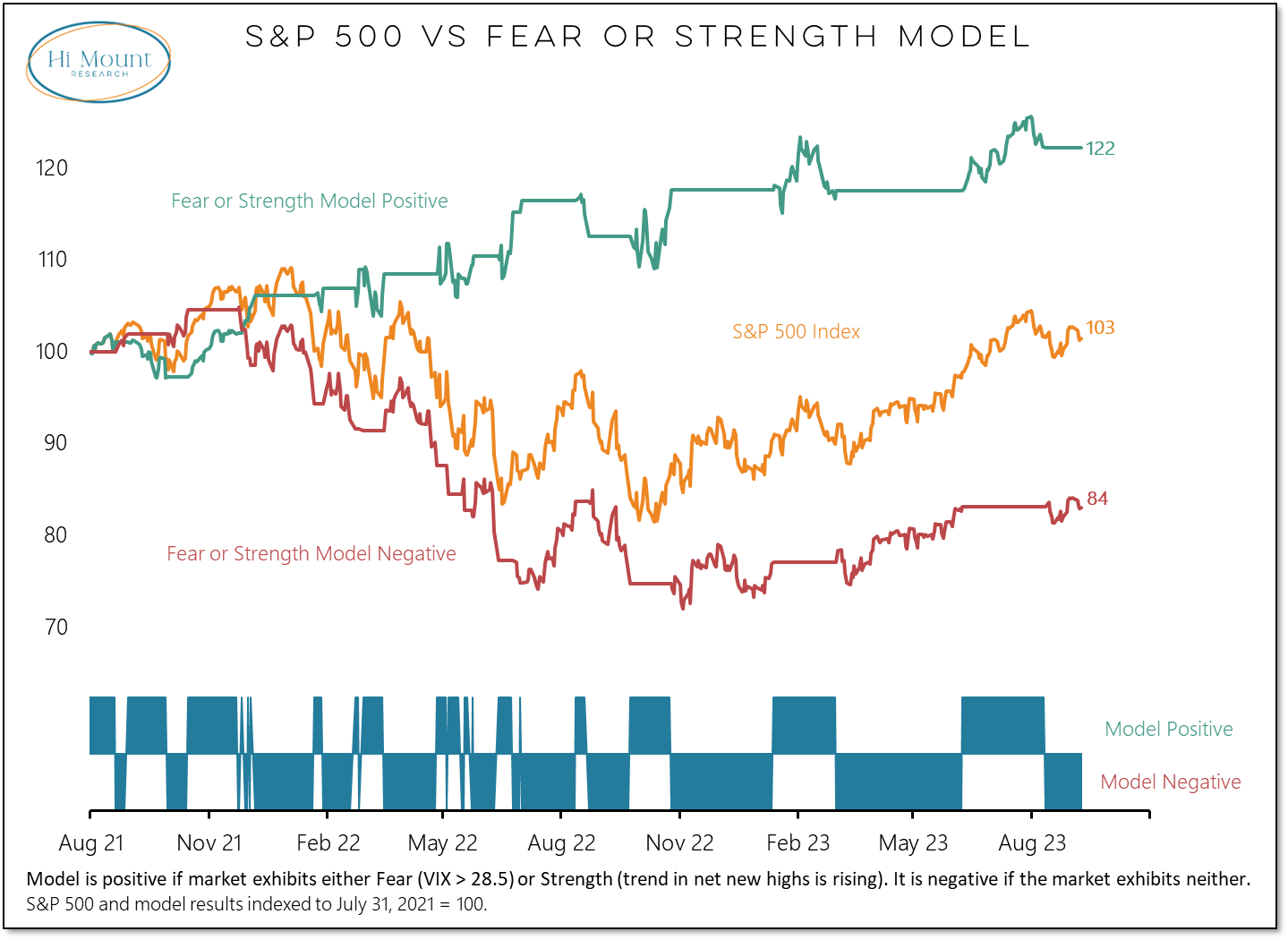

Key Takeaway: With our Cyclical Weight of the Evidence arguing for caution and our Tactical “Fear or Strength” model (see below) making the case less is more from an equity exposure perspective right now, we have moved away from stocks and toward commodities in our dynamic ETF portfolios. These moves are broadly consistent with the recent message from our systematic models.

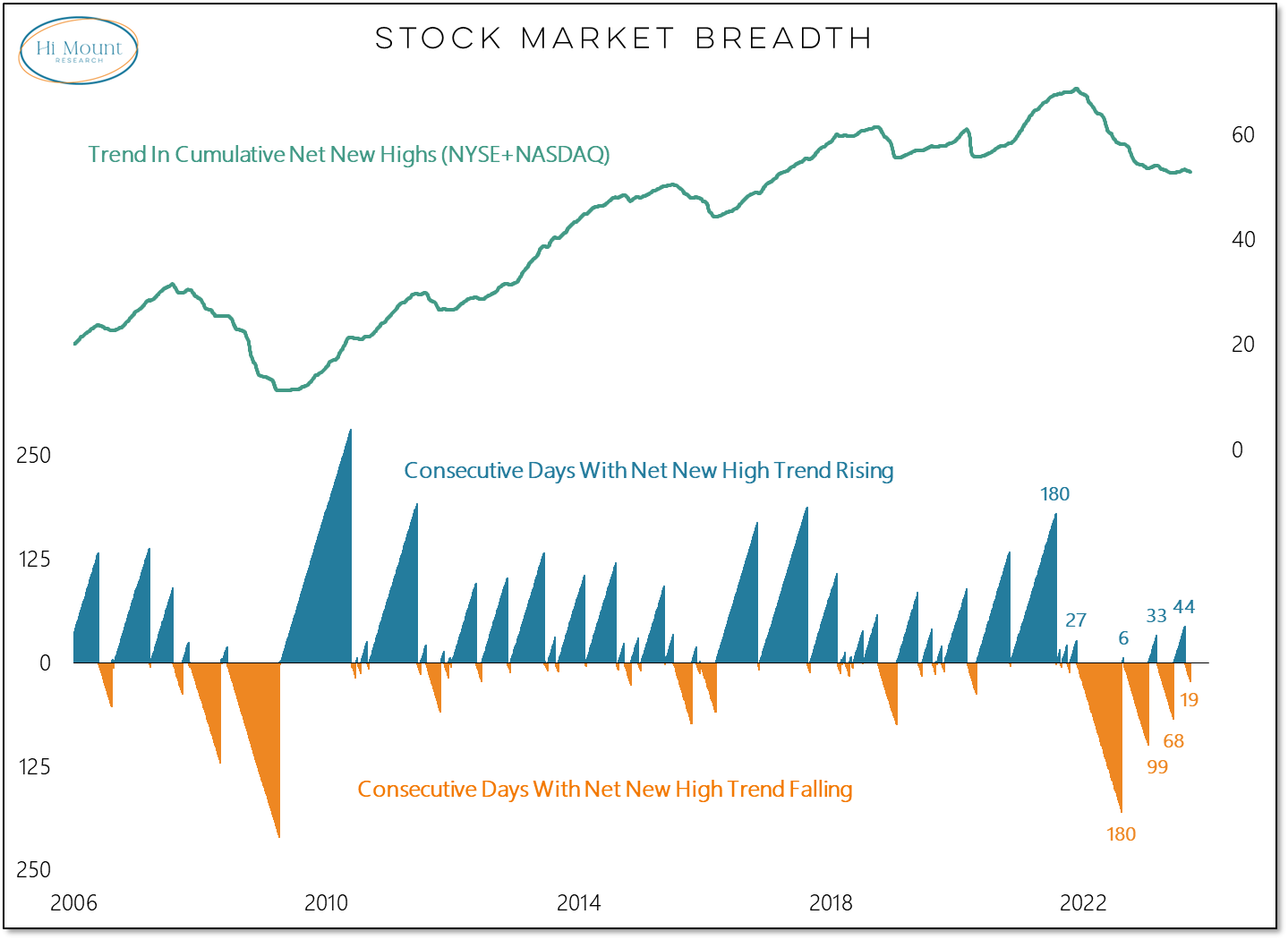

More Context: The market right now is exhibiting neither fear (elevated VIX) or strength (new highs > new lows). When that has been the case over the past two years, the S&P 500 has fallen 16% (versus a 22% gain in that time period in the presence of either fear or strength).

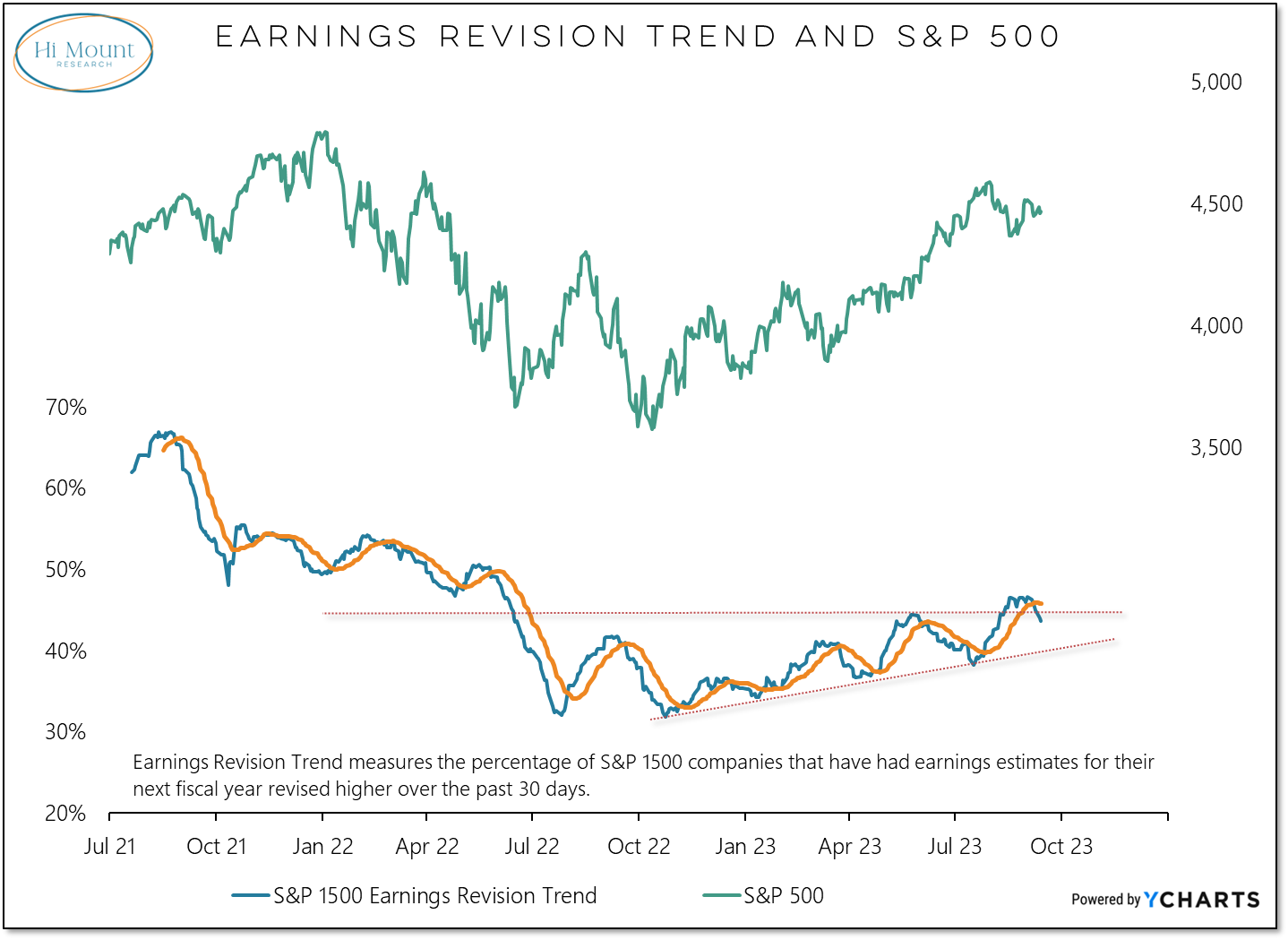

The tape is not the bull’s friend in this environment and the bending lower of the earnings revision trend adds to the downside risks for stocks.

Meanwhile on the economic front, households are making and spending record amounts of money but purchasing power has not expanded and real growth has stalled. The macro and the market indicators are moving toward the same theme: more risk and less opportunity.