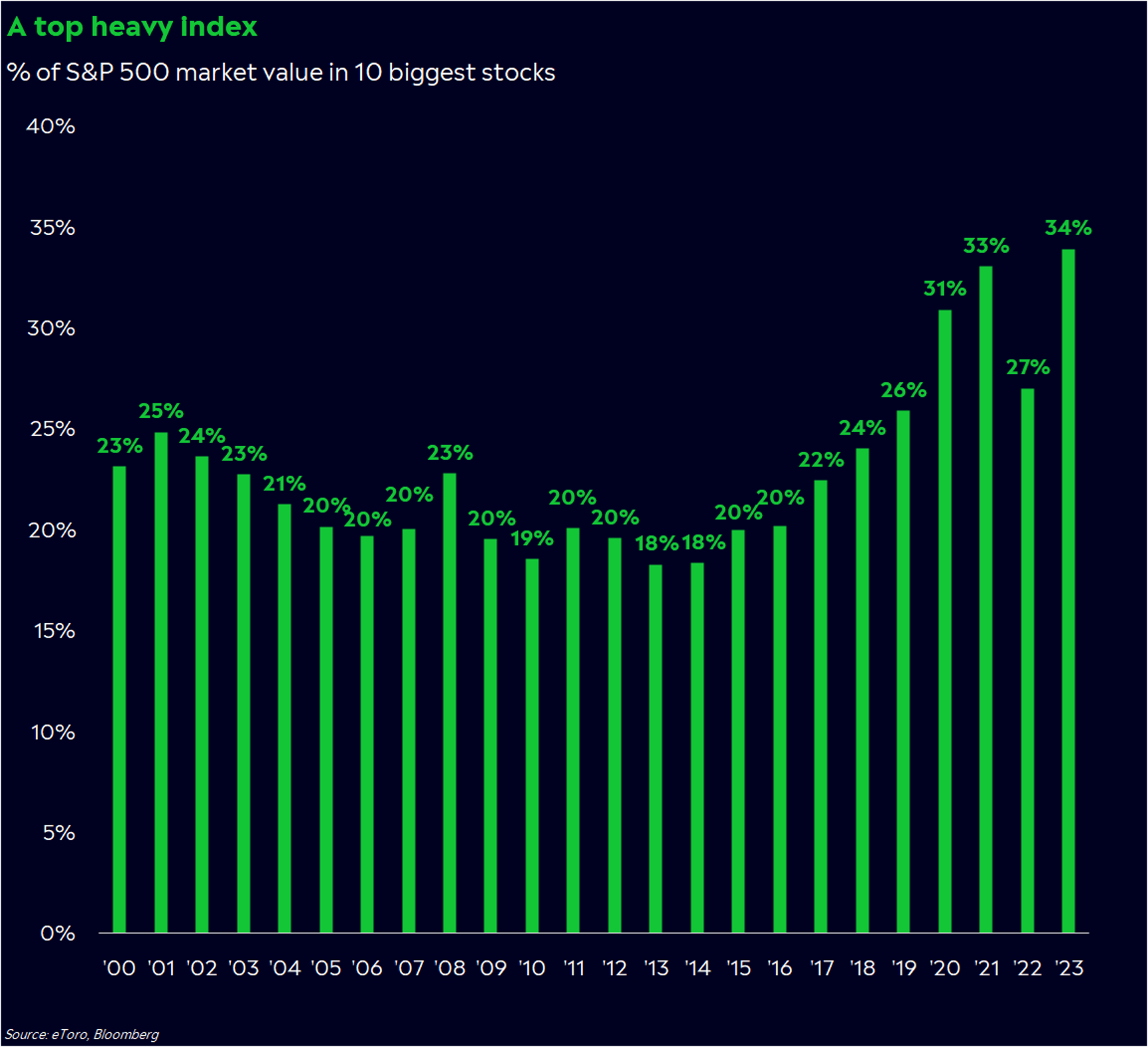

Key Takeaway: As most stocks have struggled in 2023, the S&P 500’s continued resiliency is more reliant on just a handful of stocks than at any point in the recent past.

More Context: The two largest stocks in the S&P 500 account for more than 14% of the index. For the third time in the past four years, the top 10 stocks make up more than 30% of the index. Over the two prior decades, it had never exceeded 26% and more often than not was 20% or lower.

US Exceptionalism: This top-heavy concentration in the US is not just historically unique, it is out of step with the rest of the world.

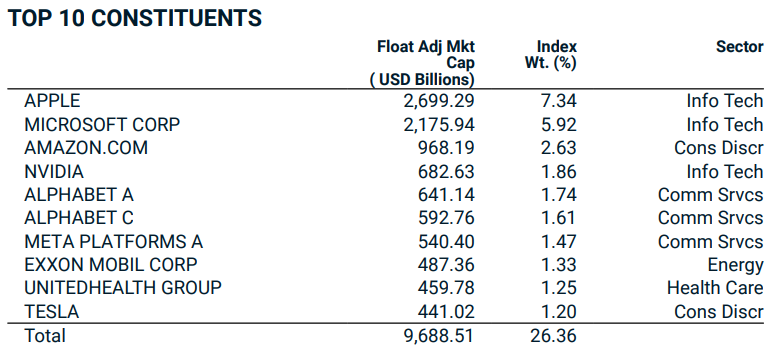

Switching gears from the S&P 500 to the MSCI indexes allows for apples to apples comparisons. The top 10 stocks in the MSCI index for the US are 26% of the index:

MSCI US Index

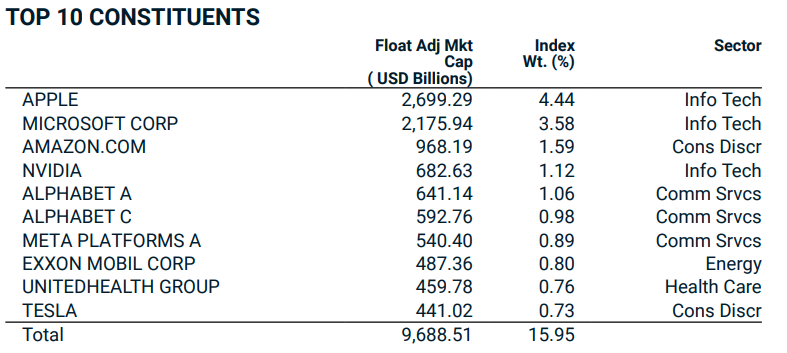

These also happen to be the top 10 stocks in the MSCI All-Country World Index (ACWI), though within the ACWI they are only 16% of the index:

MSCI All-Country World Index (ACWI)

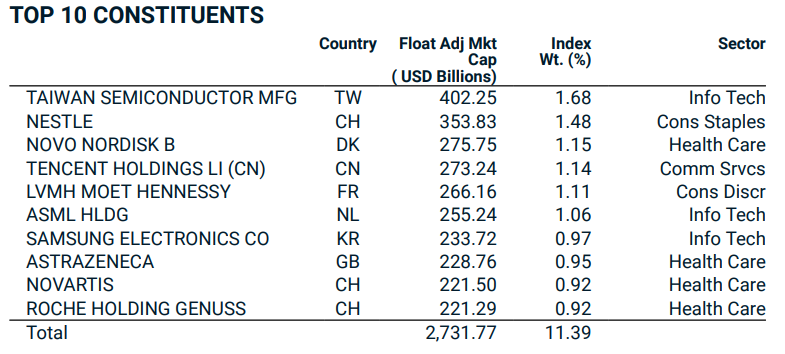

Remove the US (and the influence of its mega-caps) and the rest of the world appears more equally-weighted. The top 10 stocks in the ACWI ex US are only 11% of the index.

MSCI ACWI ex US Index

The index-level influence of US mega-caps is more acute now than in the past. A top-heavy structure is not doomed to collapse, but the absence of a broad foundation reduces stability and increases vulnerability.