Key Takeaway: Investors have embraced equities in both word and action. That optimism is being rewarded as stock market trends remain strong and rally participation is historically strong and continuing to improve. After a period of persistent pessimism, the crowd is turning giddy. Rather than seeing that as a headwind, remember that we need bulls to have a bull market.

Two area of focus:

Sentiment: While there is plenty of focus on how bullish investors are right now, remembering the persistent pessimism of the recent past provides meaningful context. It is not elevated optimism that is a headwind for stocks, it is retreating optimism that brings volatility. The pendulum is still swinging in favor of the bulls.

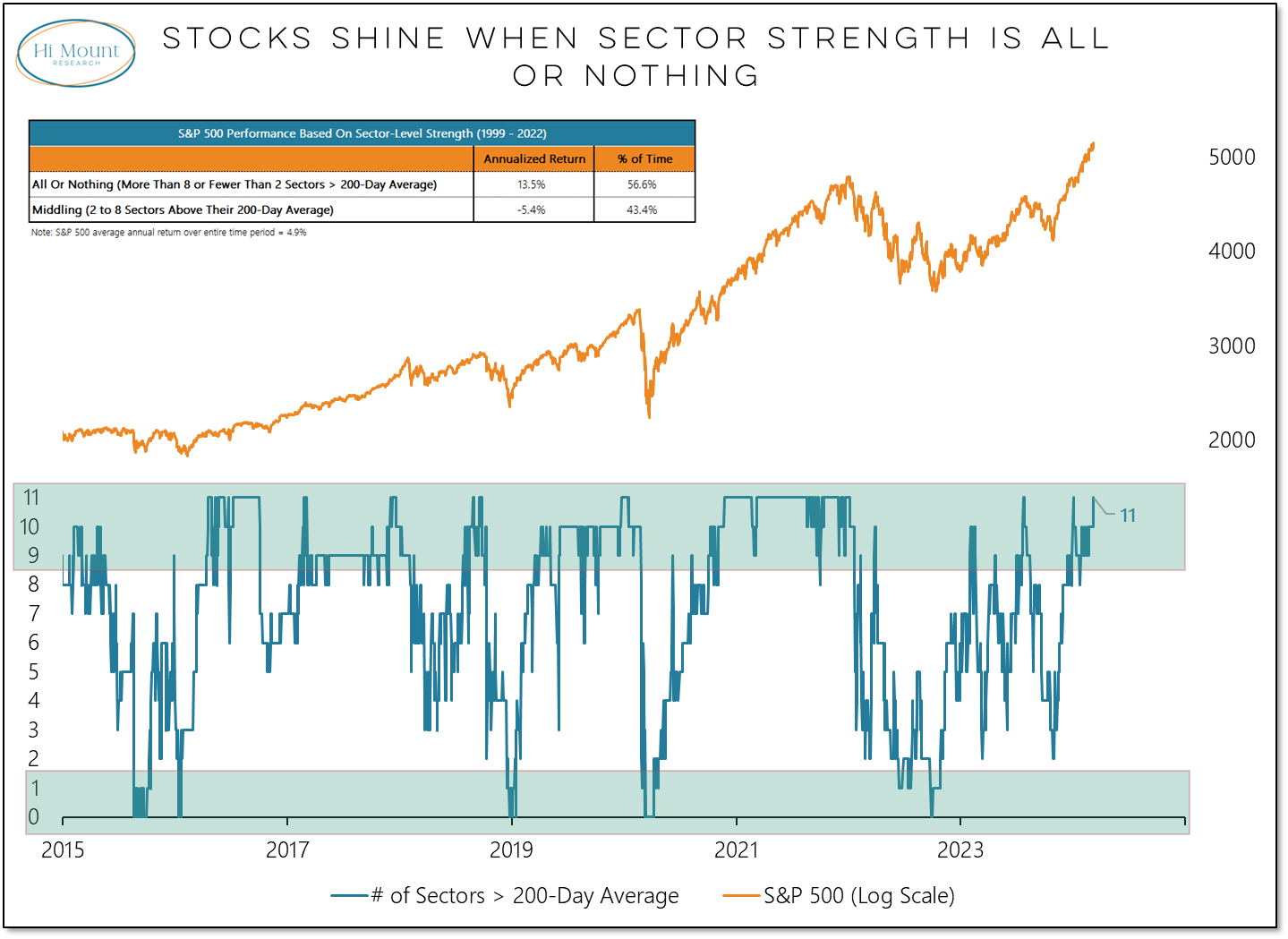

Market Trends & Momentum: All eleven sectors in the S&P 500 are trading above their 200-day averages and the percentage of stocks in the index that are above their 200-day averages has broken out to a new recovery high. Strength begets strength.

Download the entire Weight of the Evidence report.