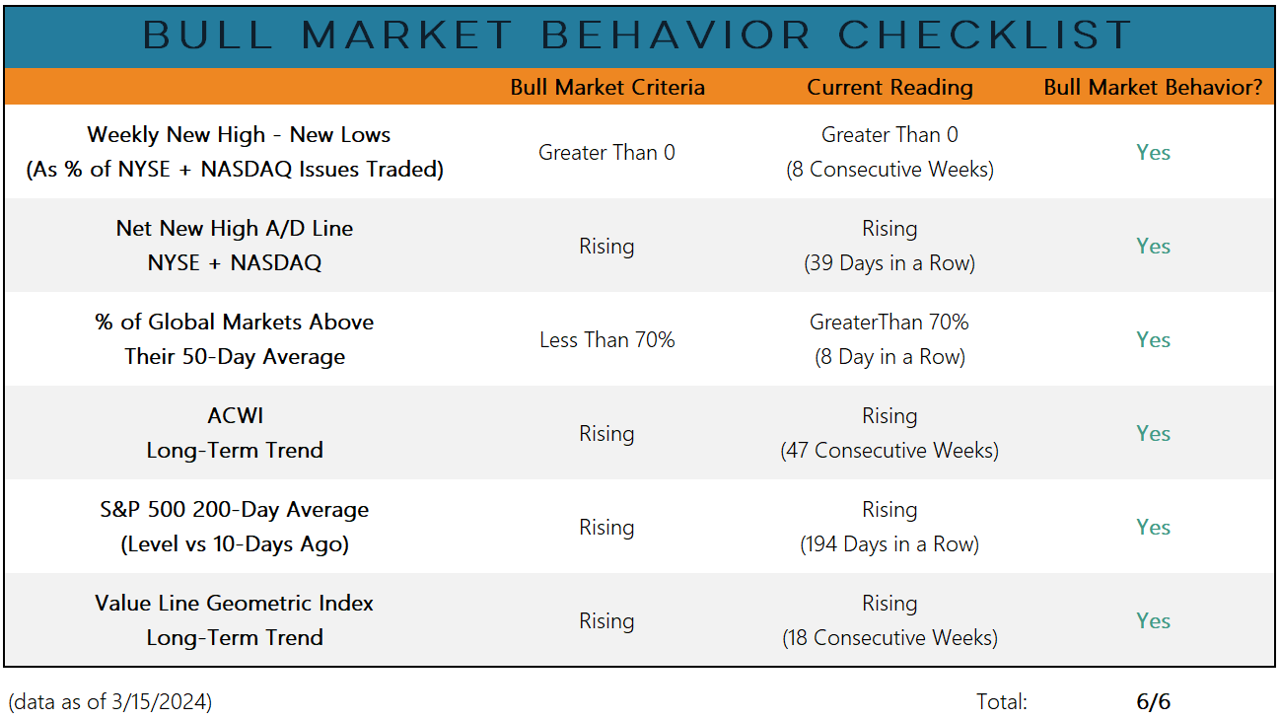

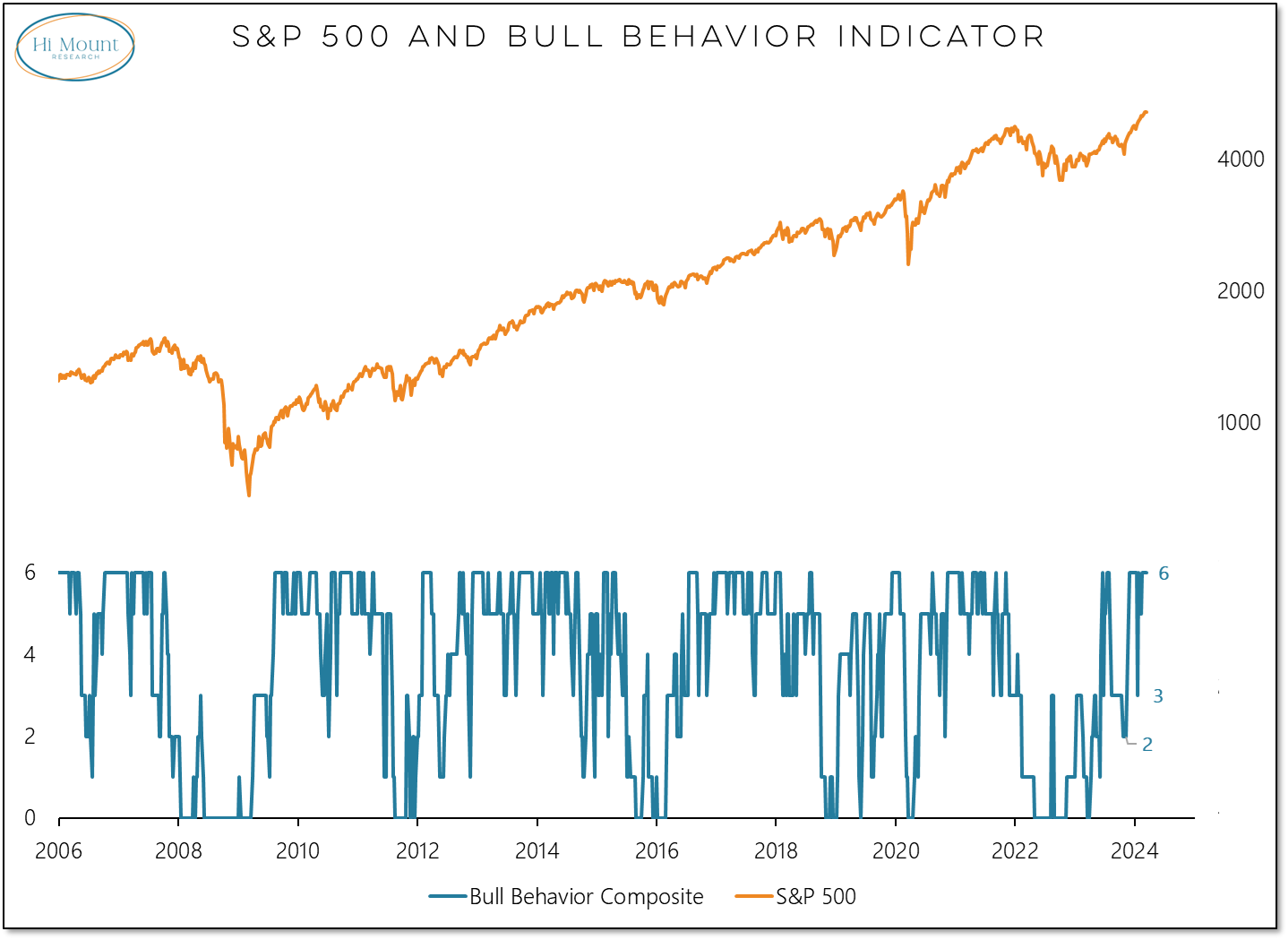

Key Takeaway: More stocks are making new highs than new lows. Our Bull Market Behavior Checklist reveals that where it matters most, the rally is firing on all cylinders. Risks become more acute after cracks emerge in the foundation and the crowd begins to turn.

As long a breadth and trend indicators show a persistence in bull market behavior, elevated optimism can continue to simmer.

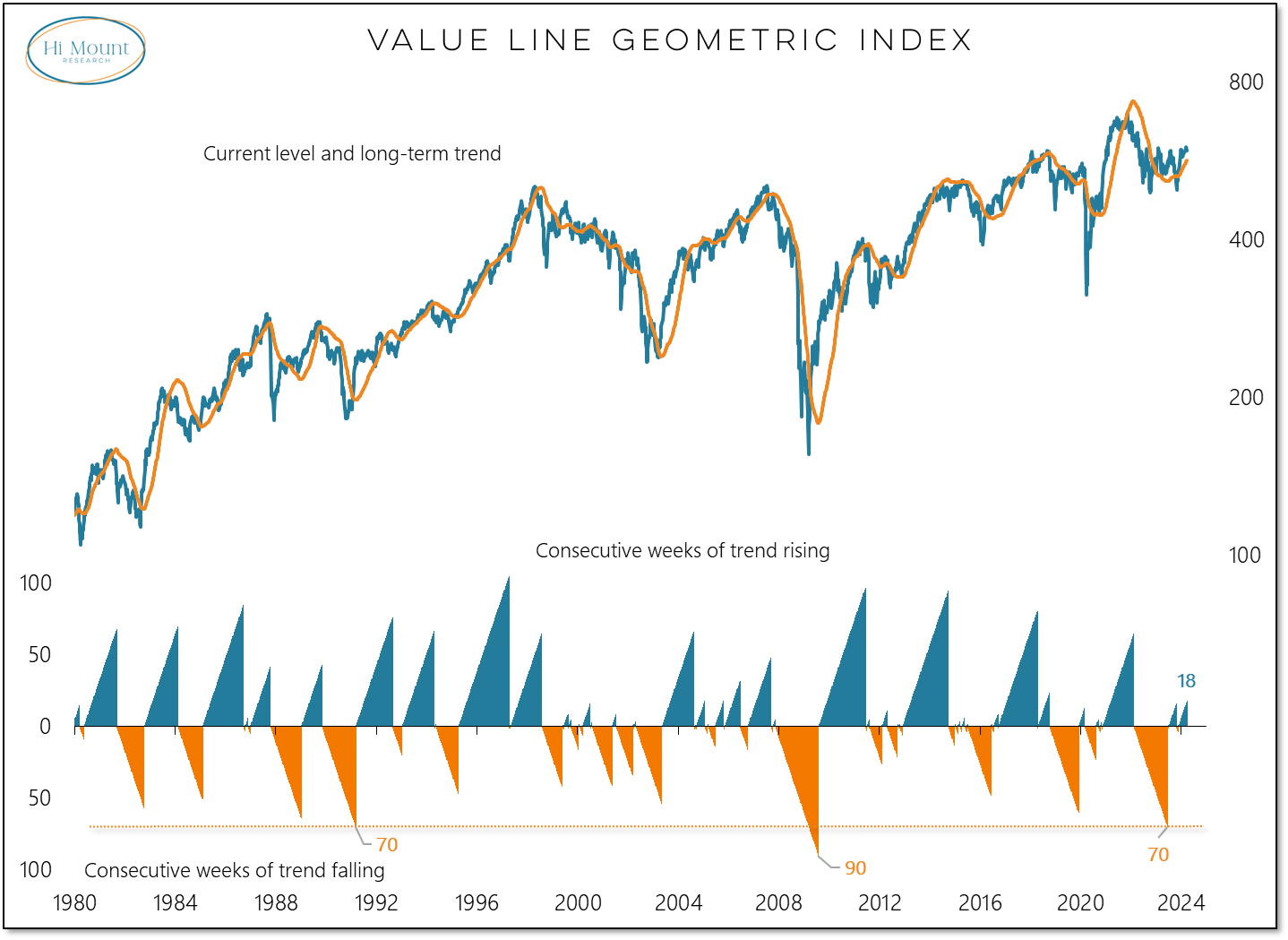

The Value Line Geometric Index captures the median performance out of a universe of 1500+ stocks. When the long-term trend is rising, it doesn’t make much sense to claim that the indexes are only being supported by a handful of mega-cap stocks. Smaller stocks have lagged and may be more prone to stumbling but right now more stocks are moving higher than lower.

For more charts and insights, download the entire Bull Market Behavior Checklist report.