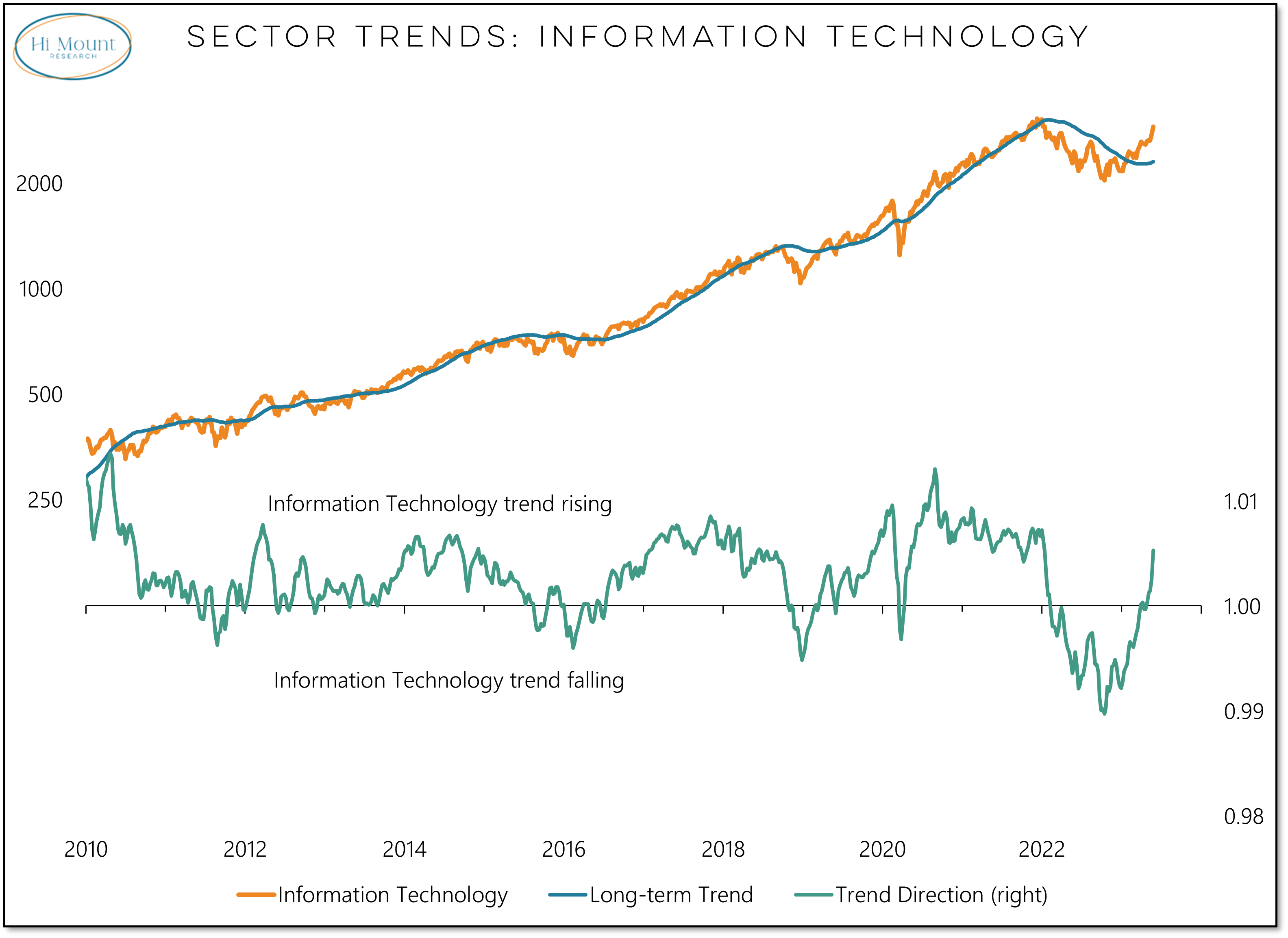

Key Takeaway: Breadth is bad, but when the largest sector goes vertical, index-level trends tend to improve. The Technology sector’s large and growing influence in cap-weight US indexes is hard to overlook.

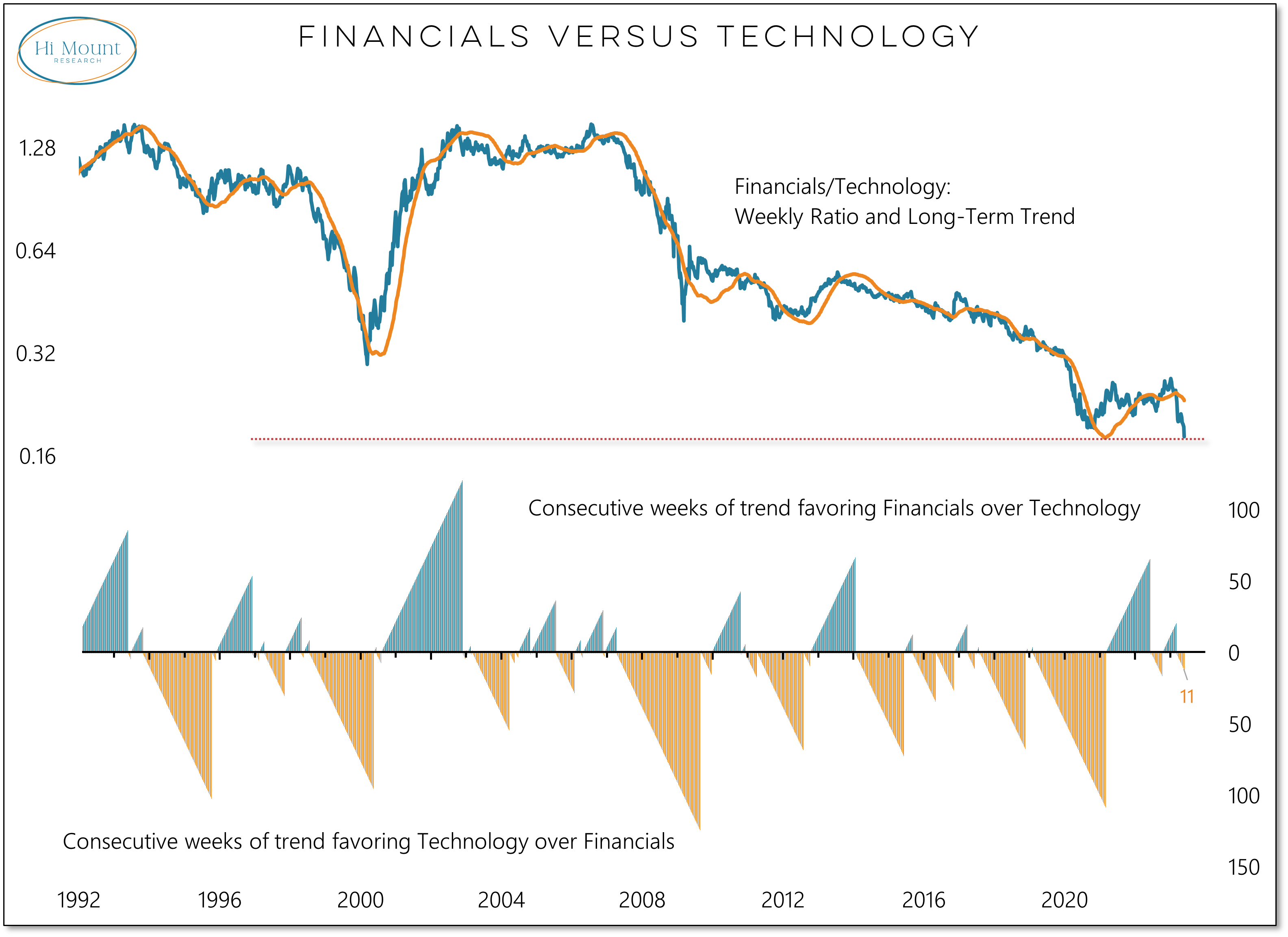

More Context: The technology sector now accounts for more than 30% of the S&P 500. While Financials and Industrials are often seen as bellwether sectors for the index but in terms of driving the direction of the index, their relative importance is waning. Over the course of 2021 and into 2022, Financials experienced their longest sustained period of strength versus Technology in nearly a decade. But that strength has faded and the ratio between Financials and Technology is at its lowest level in at least 30 years.

Implication: Our Blue Heron Global Equity model is increasing exposure to the US, largely at the expense of exposure to Pacific ex Japan.

Next Step: Download our Asset Allocation Model report for details on how trends in the US and around the world are shifting.