Key Takeaway: In our monthly call for August, we look at the evidence of improving rally participation that has emerged in recent weeks and how that is in tension with a cautious message from a weight of the evidence perspective. After a period of quiet strength, rising bond yields and excessive investor optimism could test the resiliency of the recent rally.

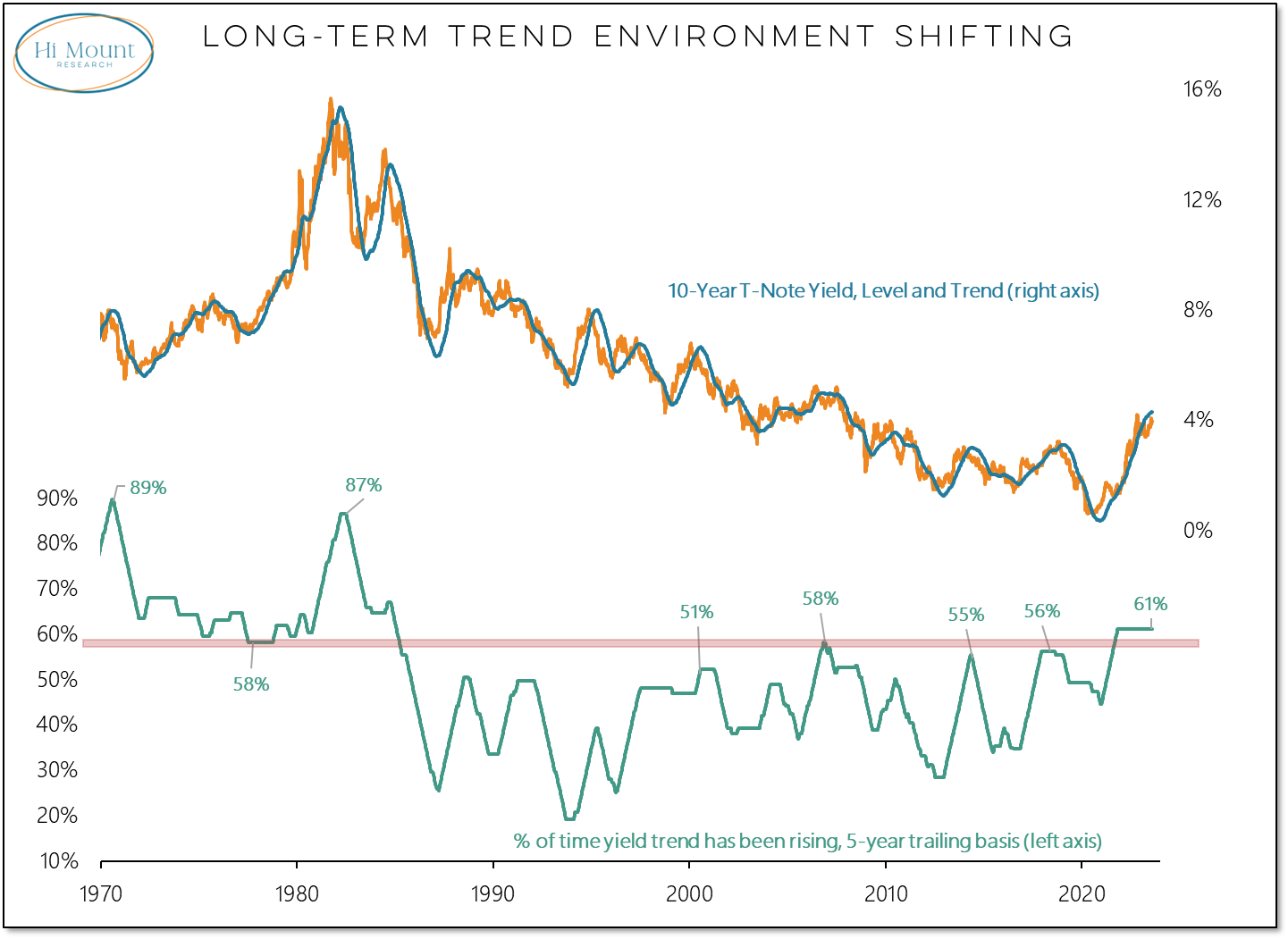

More Context: In recent months, price and breadth trends have been tailwinds for stocks. Rising bond yields and investor optimism are risks from a Weight of the Evidence perspective. Not only is the long-term trend in the 10-year T-Note yield still rising (137 weeks and counting) but the trend environment of the past 4 decades appears to have shifted. The pattern of lower highs and lower lows in yields has ended and higher yields are proving to be persistent.

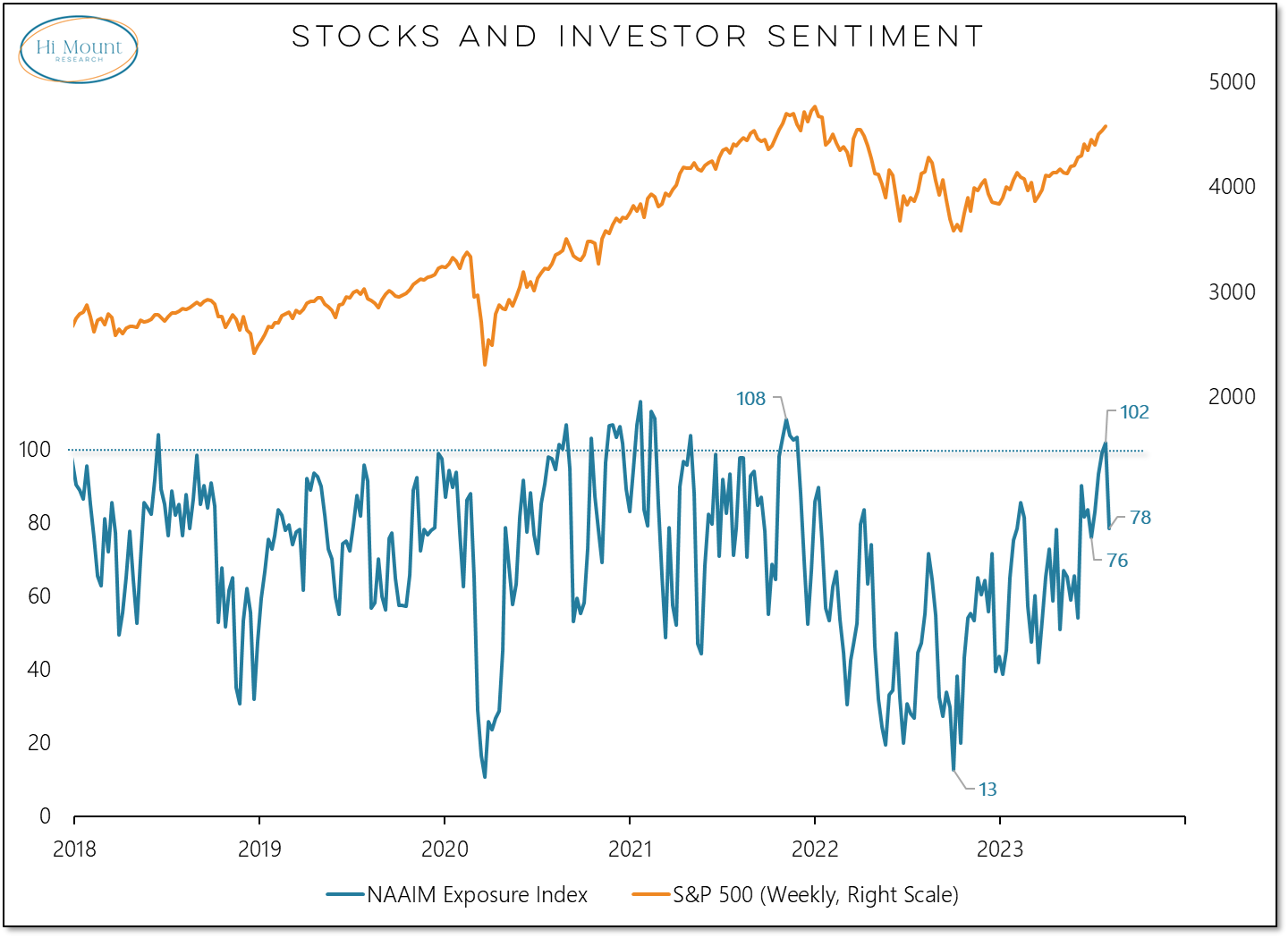

You need bulls to have a bull market and we celebrated a return to investor optimism after a period of persistent pessimism. But that optimism has now turned excessive and is a headwind for stocks. The goal is not to be arbitrarily contrarian, but to go with the crowd until it reverses at an extreme. Last week’s NAAIM exposure index > 100 was extreme. This week’s drop below 80 looks like a reversal. Undercutting the June low (76) would confirm that.

Go Deeper: This month’s video update is unlocked. You can watch it here or skip it and just download the slide deck.