Blue Heron Systematic Models

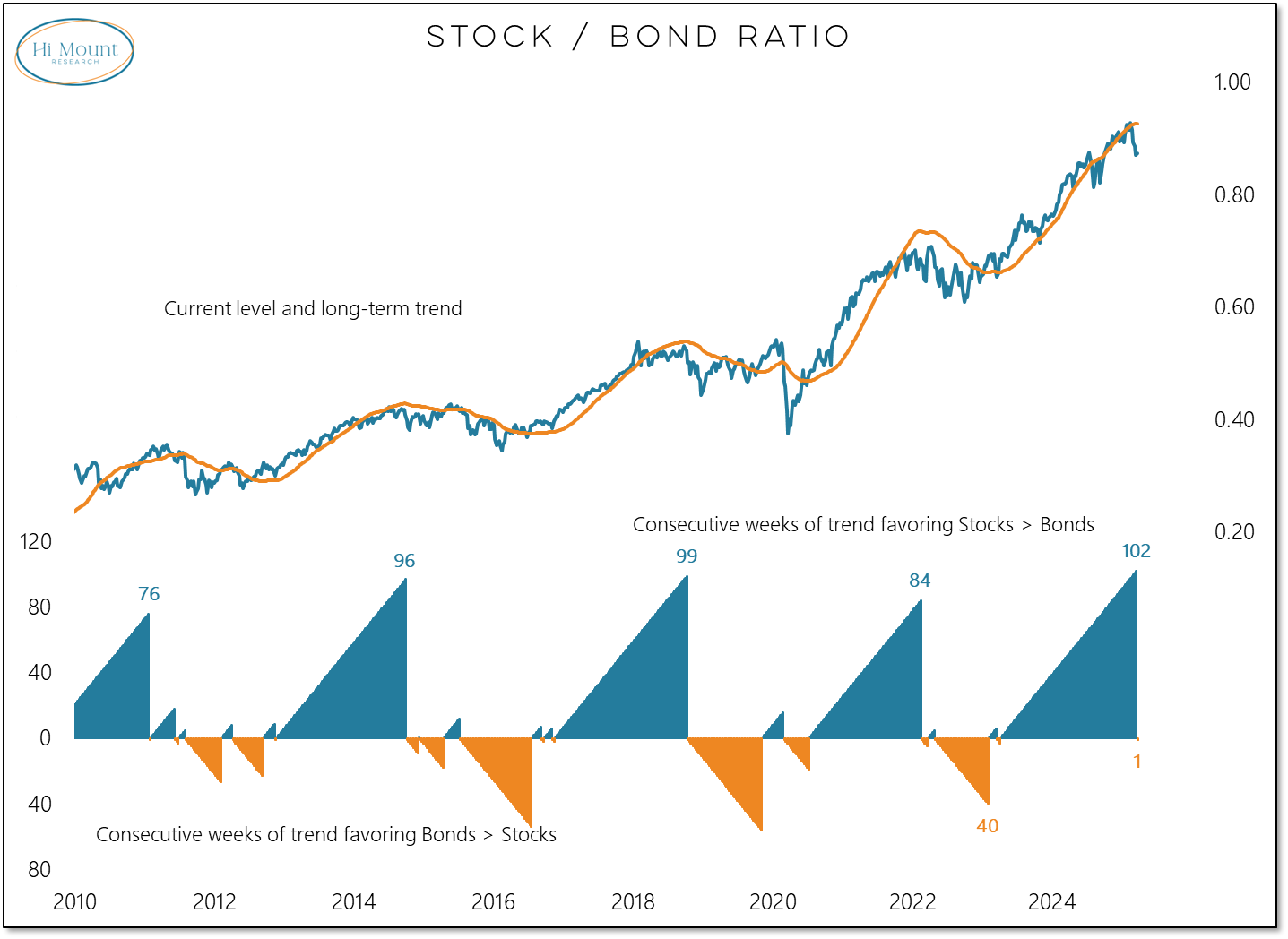

Key Takeaways: While our Blue Heron Systematic Portfolios are updated monthly, the models they are based on use weekly data. With that data shifting in meaningful ways, we are providing a mid-month update that could preview coming for the portfolios. Stocks have been slipping versus Commodities and have now fallen behind Bonds as well. Third place gets you a bronze metal in the Olympics, but in three-way race it is also last place.

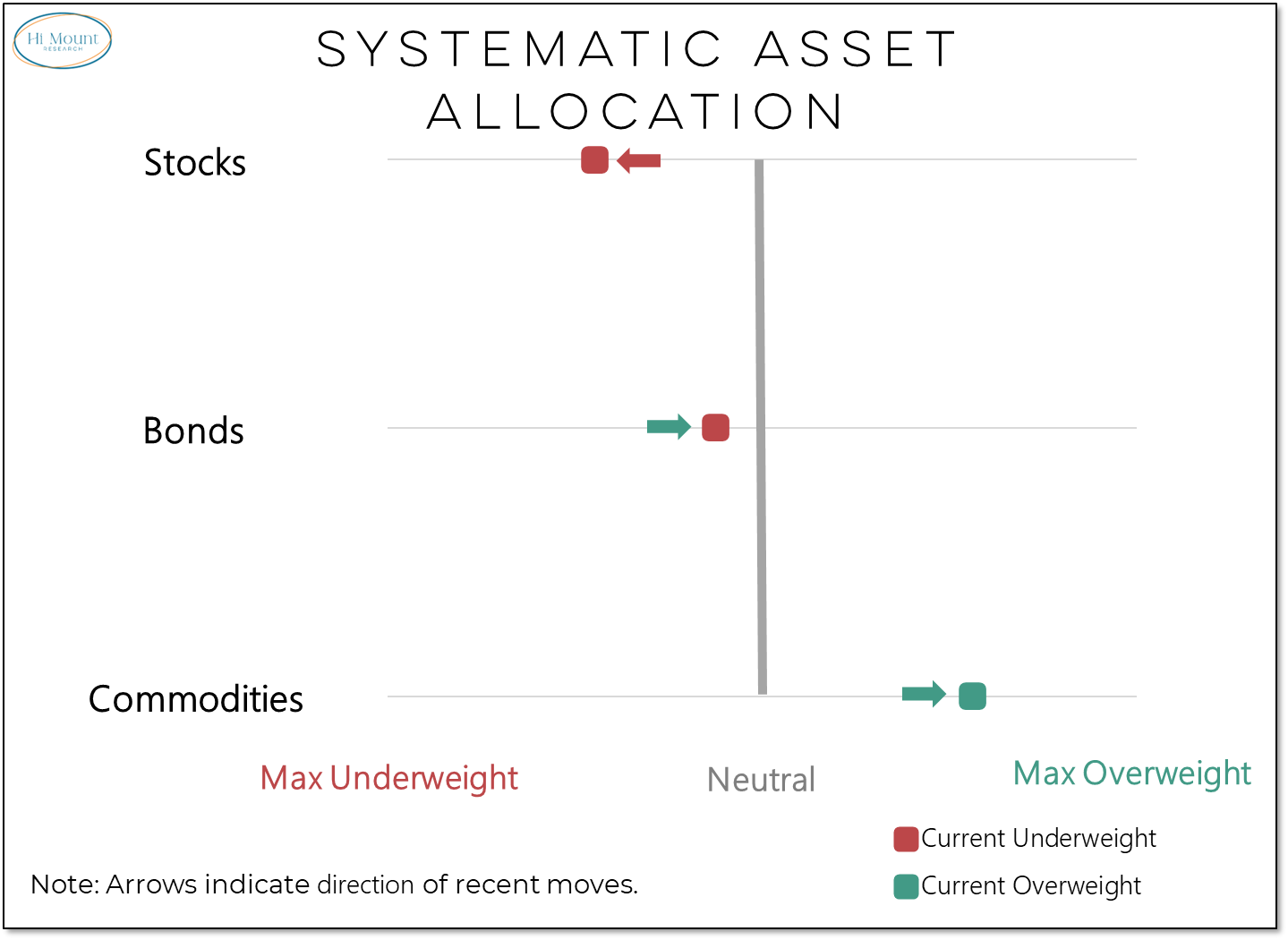

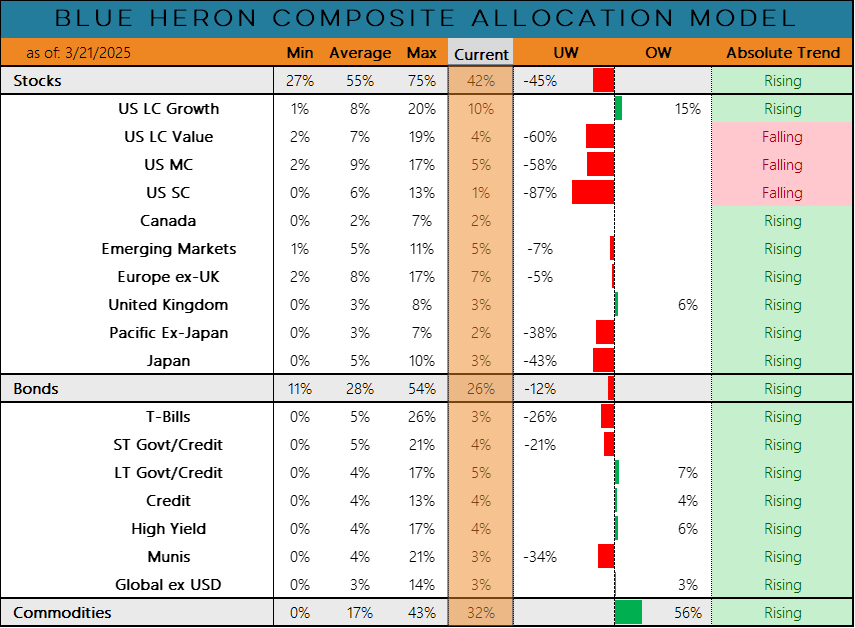

Composite: Commodities and Stocks have been trading spots at the top of the podium in recent months. Commodities currently hold the top spot and this week the trend in the between stocks and bonds has turned in favor of bonds for the first time in more than 100 weeks, bring to an end the longest sustained stretch of leadership from stocks in over a decade. Our rules-based approach now favors Commodities > Bonds > Stocks. While the absolute trend for stocks overall remains higher, there are pockets of weakness emerging in global equities.

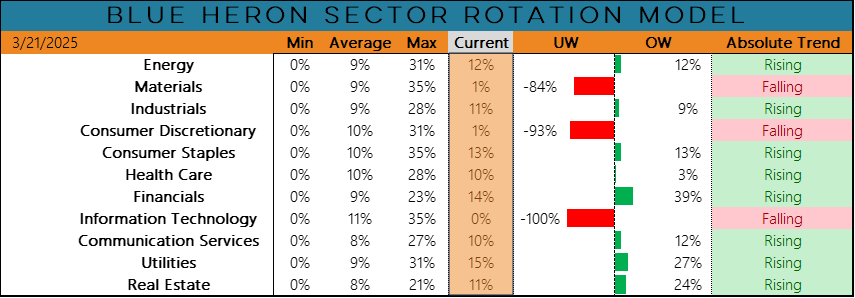

Sector Rotation: Global equity market weakness is showing up most acutely in the US. We are seeing this from a size/style perspective (as can be seen above) as well as a sector perspective (as seen below). While only 3 of 11 sectors have absolute trends that are falling, the combined market cap of those three sectors is more than 40% of the S&P 500 index.