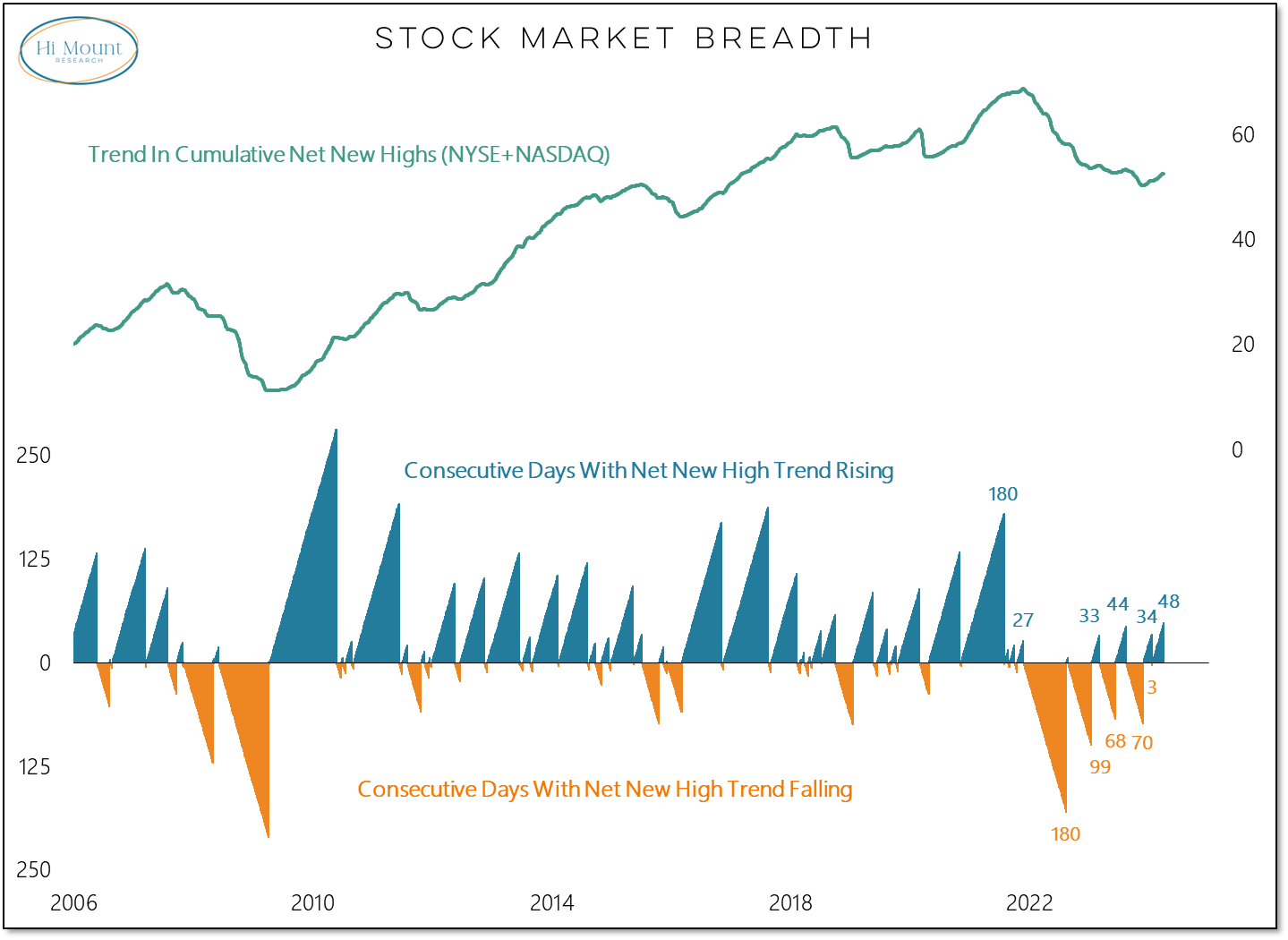

Key Takeaway: The pattern in net new highs has shifted in recent months, helping to keep our tactical Fear or Strength model tilted in a positive direction.

The trend in net new highs is experiencing its longest sustained increase since prior to the Jan 2022 peak in the S&P 500. The bear market pattern of sustained declines in the trend followed by brief interruptions of strength has been replaced with a bull market pattern of sustained strength and only hiccups of weakness.

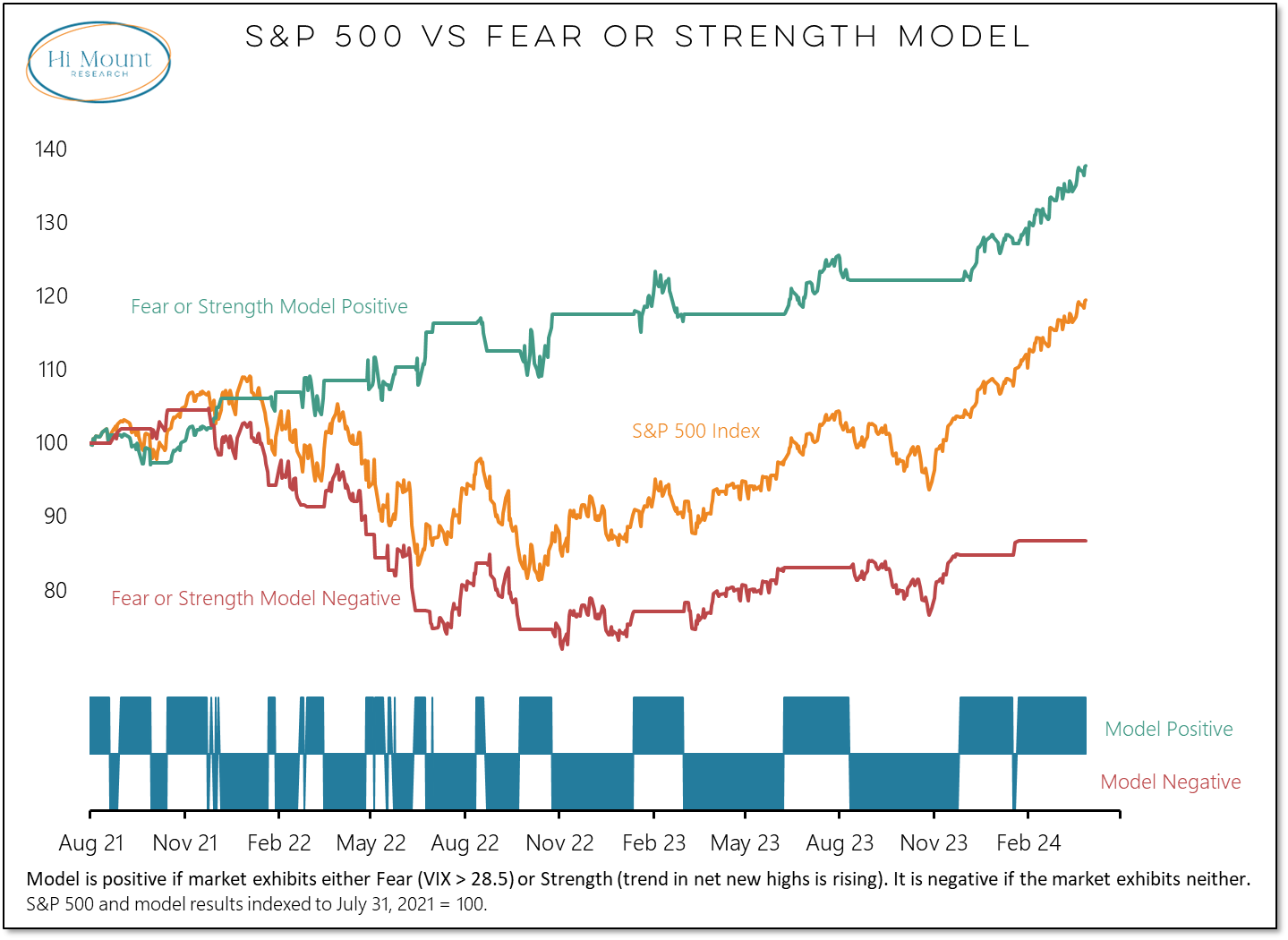

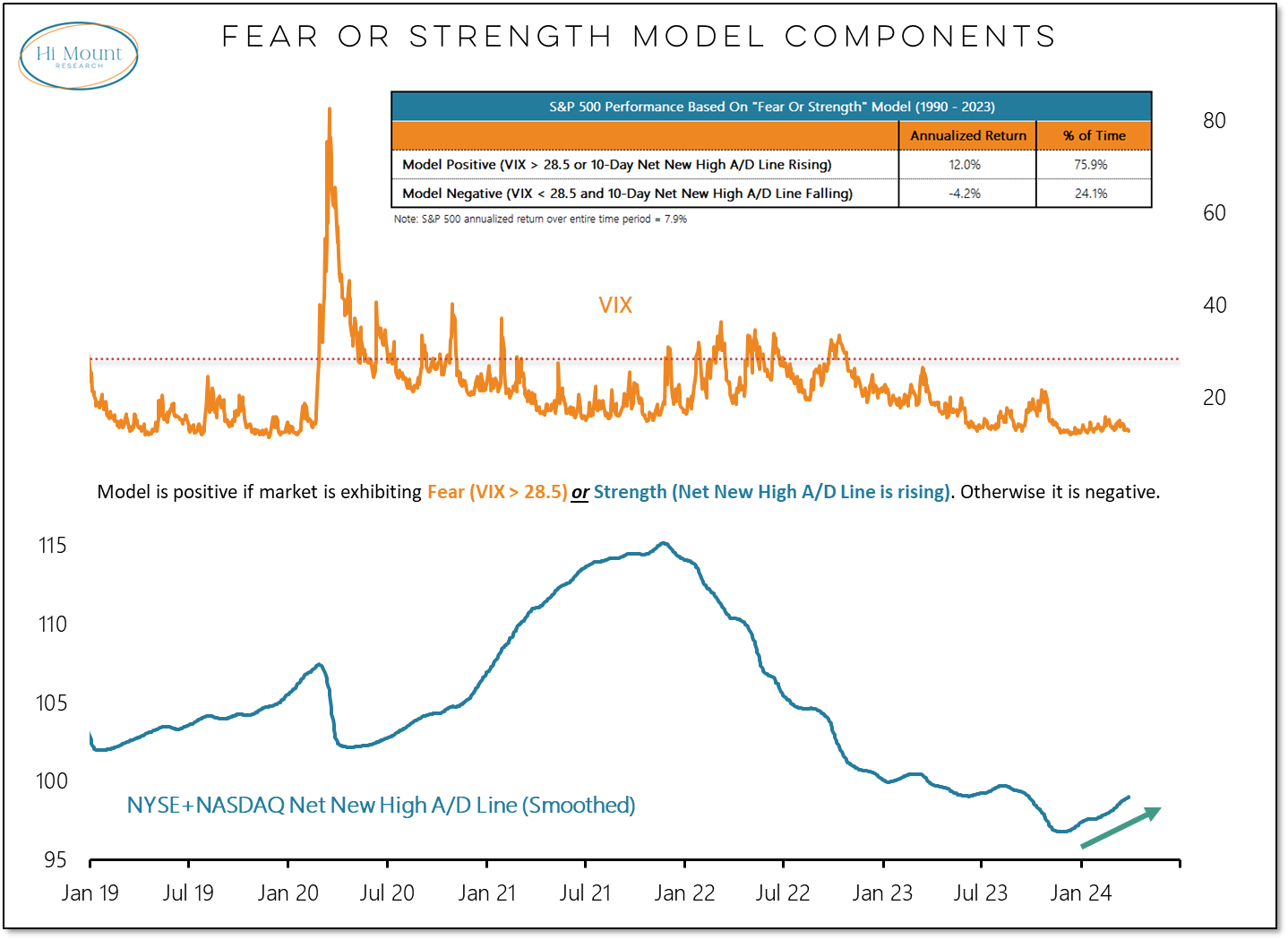

That gives our Fear or Strength tactical model with a bullish tilt toward stocks. All of the net gains in the S&P 500 over the past 3+ decades have been accompanied by either an elevated VIX (Fear) or a rising trend in net new highs (Strength).

The model has continued to work in recent years. The positive message that emerged after the Q3 2023 sell-off remains intact.