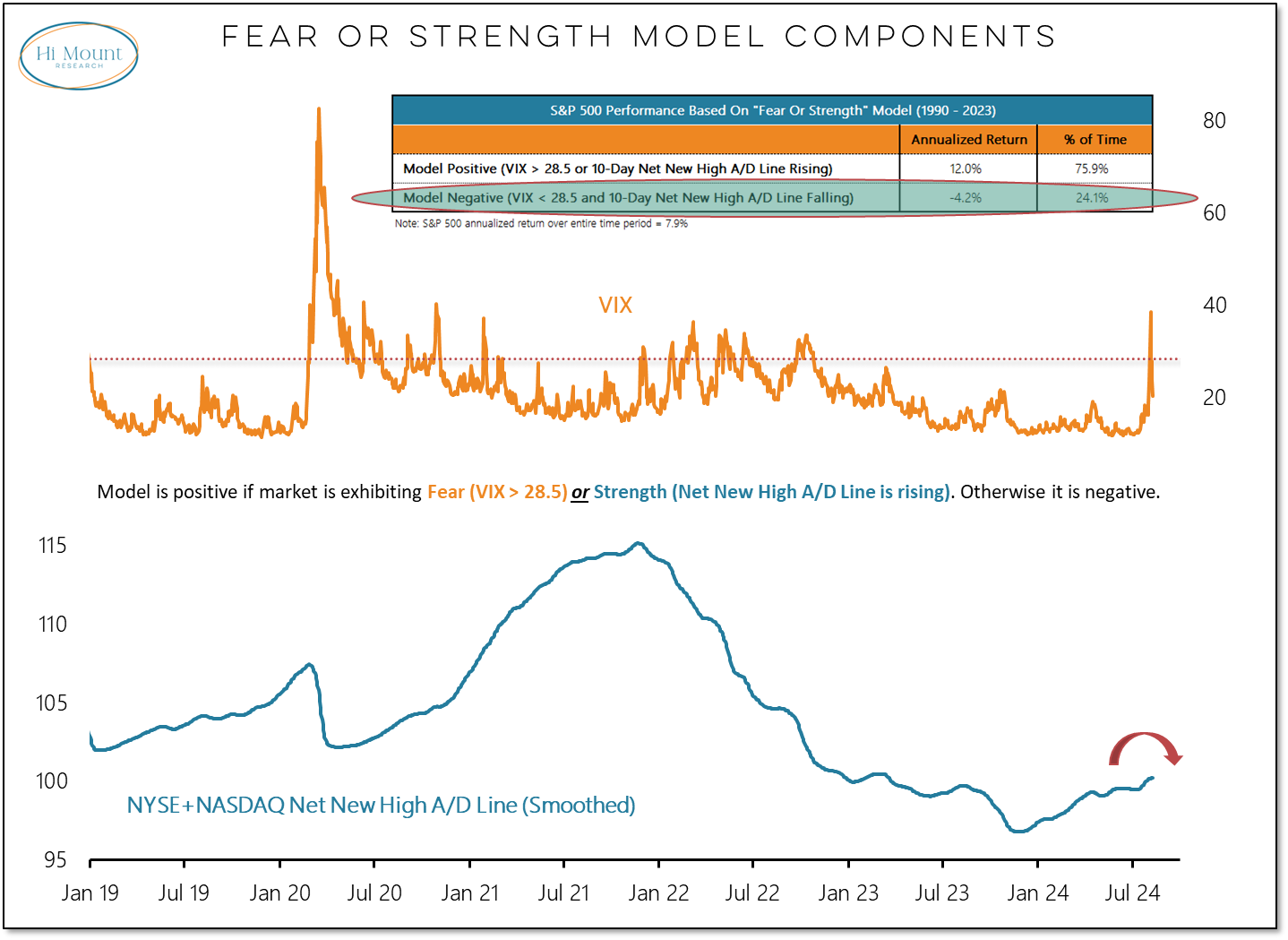

Key Takeaway: The VIX spiked and retreated while new lows have eclipsed new highs. Our Fear or Strength Model has turned negative.

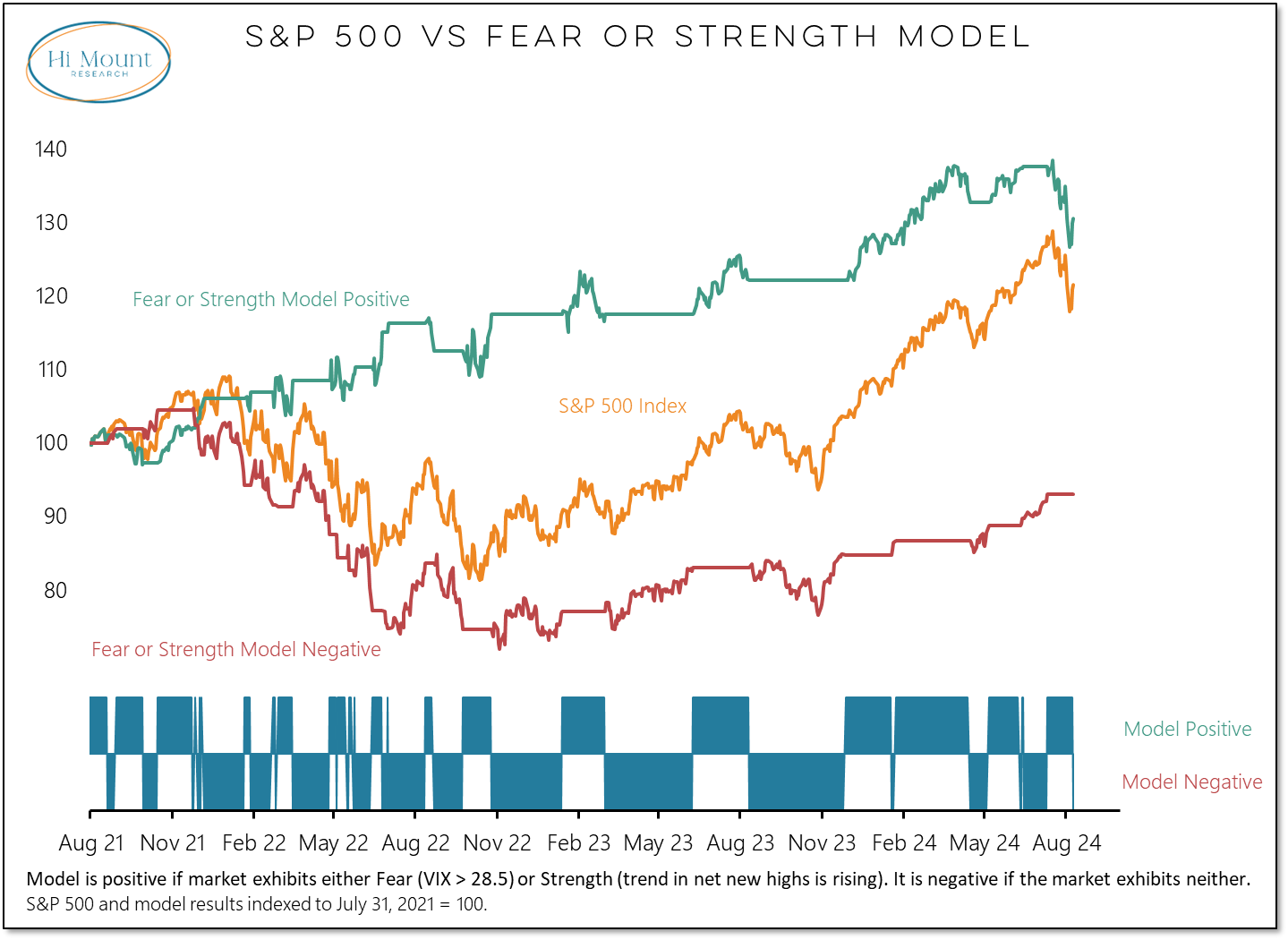

For a moment, the market was positioned to benefit from both Fear and Strength. The VIX surged higher last week while the trend in net new highs continued to rise. The S&P 500 is up 20%+ over the past three years, and virtually all of the net gains have come in periods when the VIX was above 28.5.

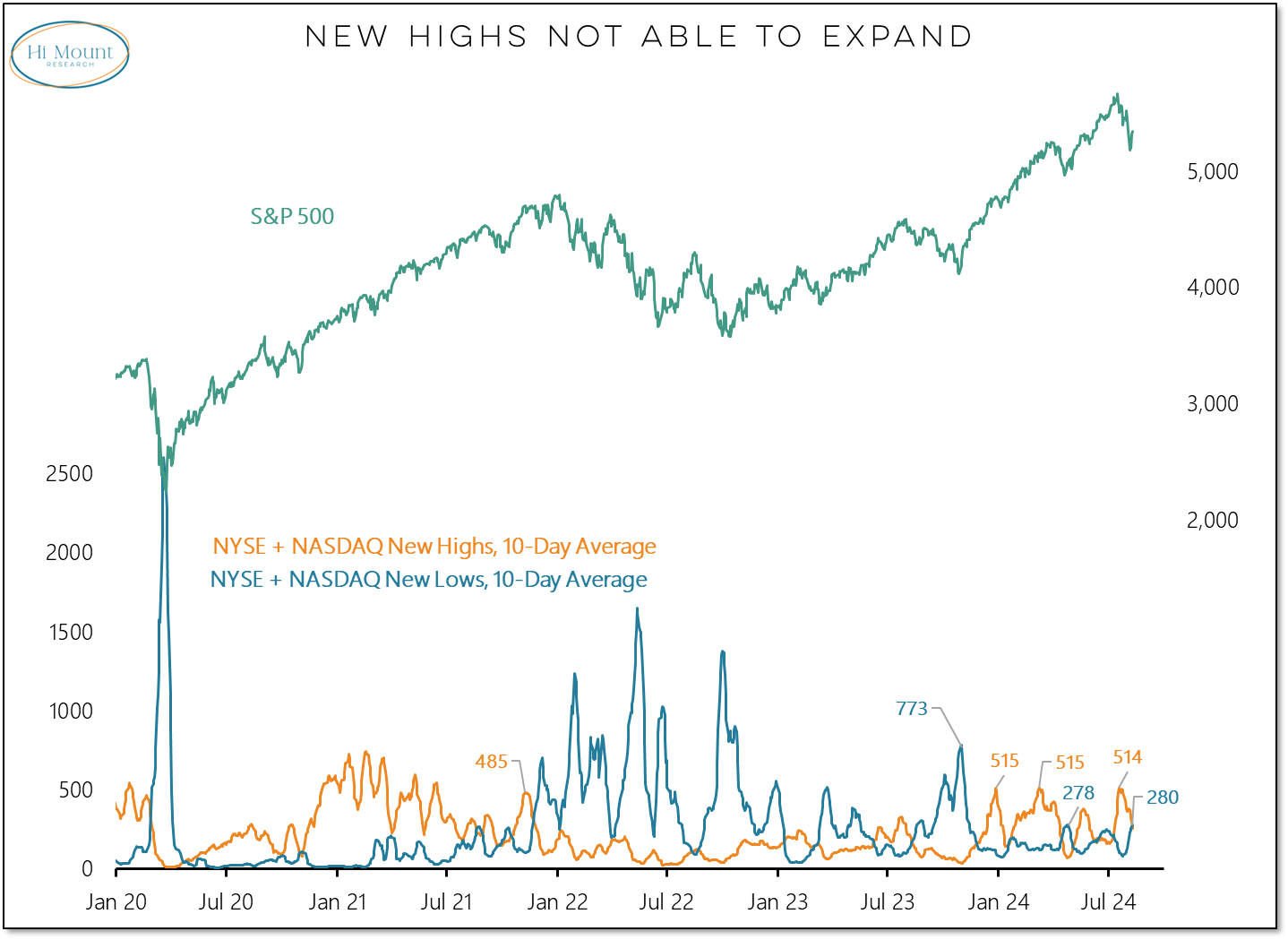

While the spike in the VIX was short-lived, on a 10-day basis new highs continued to outnumber new lows. By the end of the week, however, that advantage had evaporated. New highs have collapsed and new lows are running at a new YTD high.

We have moved from both Fear and Strength to neither Fear nor Strength. That pushes our Tactical model into negative territory.

Stocks have a long history of coming under pressure in the absence of either Fear or Strength. I don’t expect this time to be any different.