Blue Heron Systematic Portfolios

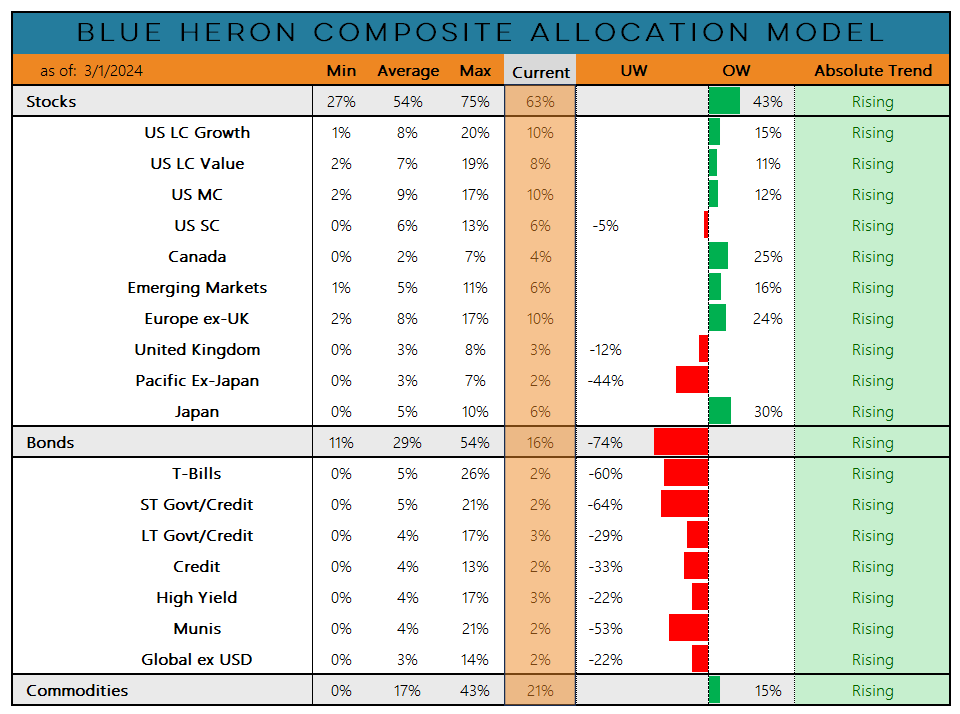

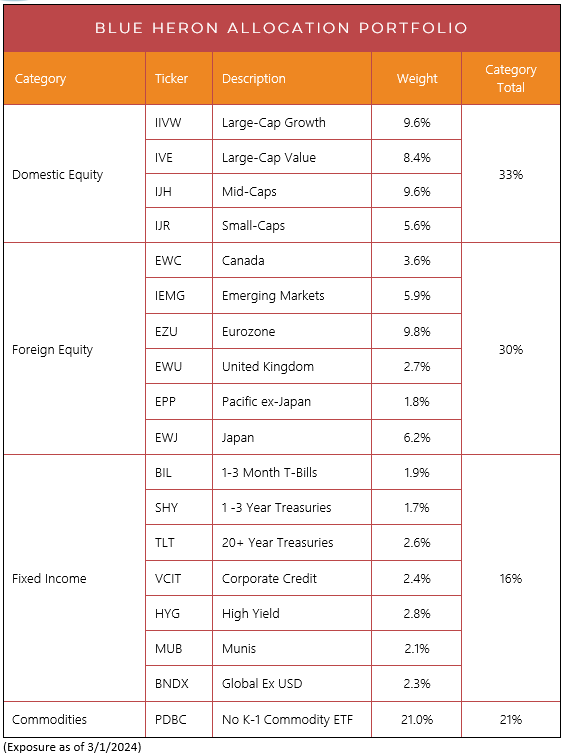

Key Takeaways: Our systematic asset allocation model has reduced exposure to Fixed Income and further increased exposure to Commodities.

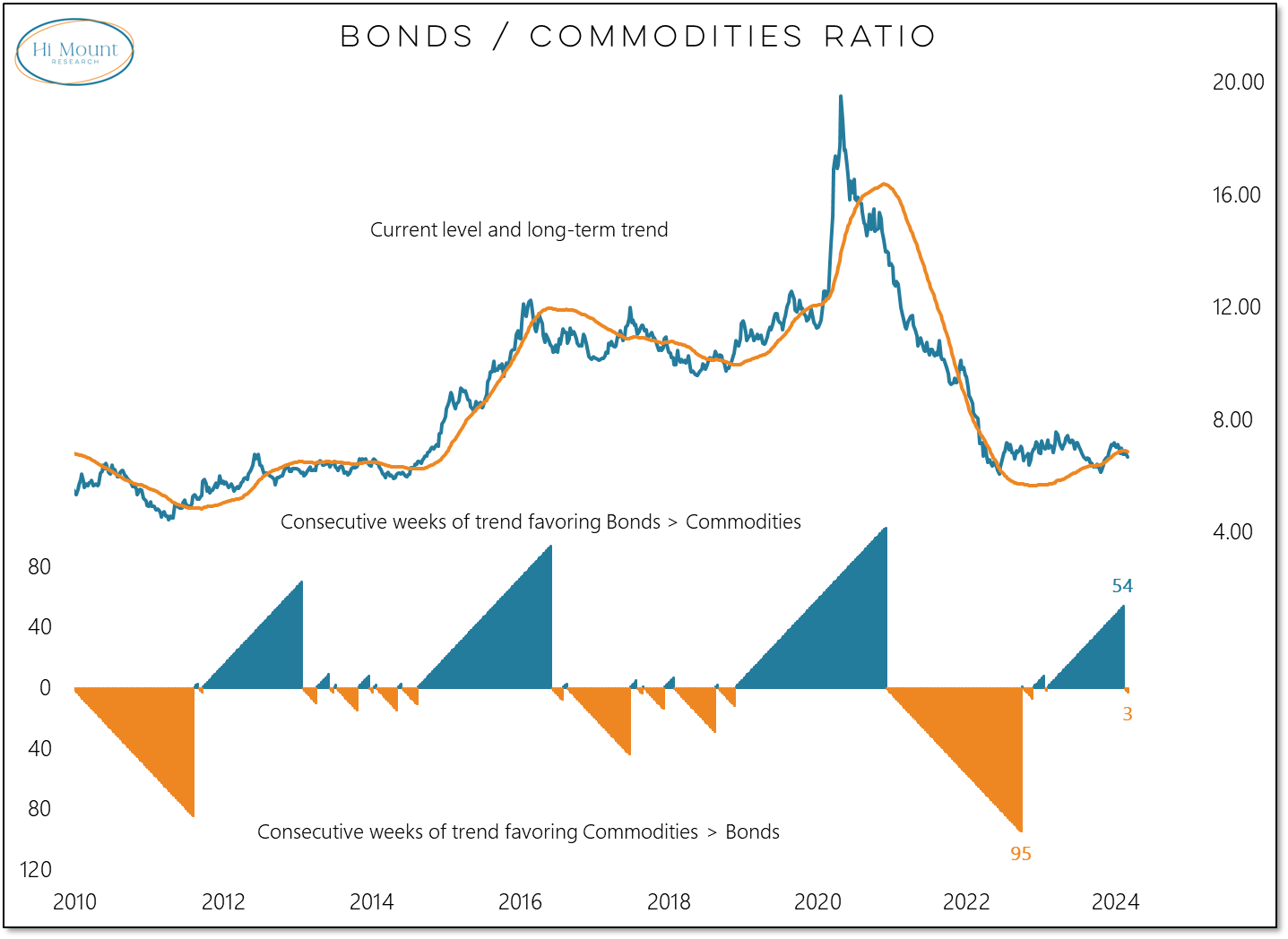

Composite: While trends are rising across the board, this months asset allocation shift reflects the movement in the ratio between Bonds and Commodities. The relative trend now favors Commodities.

.

Download the entire update to review the stand alone Equity and Fixed Income Portfolios.

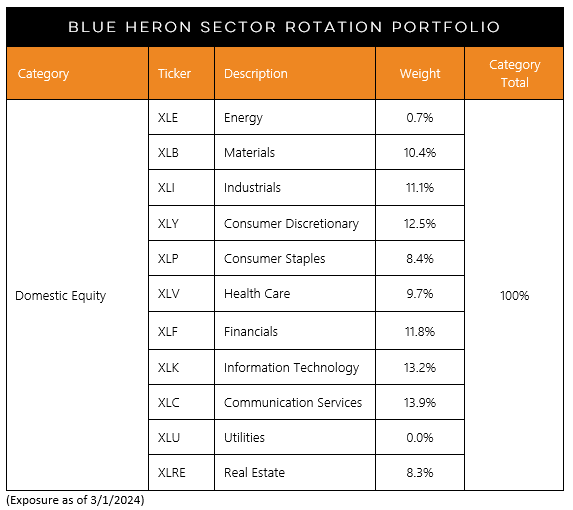

Sectors Rotation: Our Blue Heron Sector Rotation Portfolio continues to avoid Utilities and Energy. Health Care and Consumer Staples are also underweighted in the model relative to their long-term average exposure.