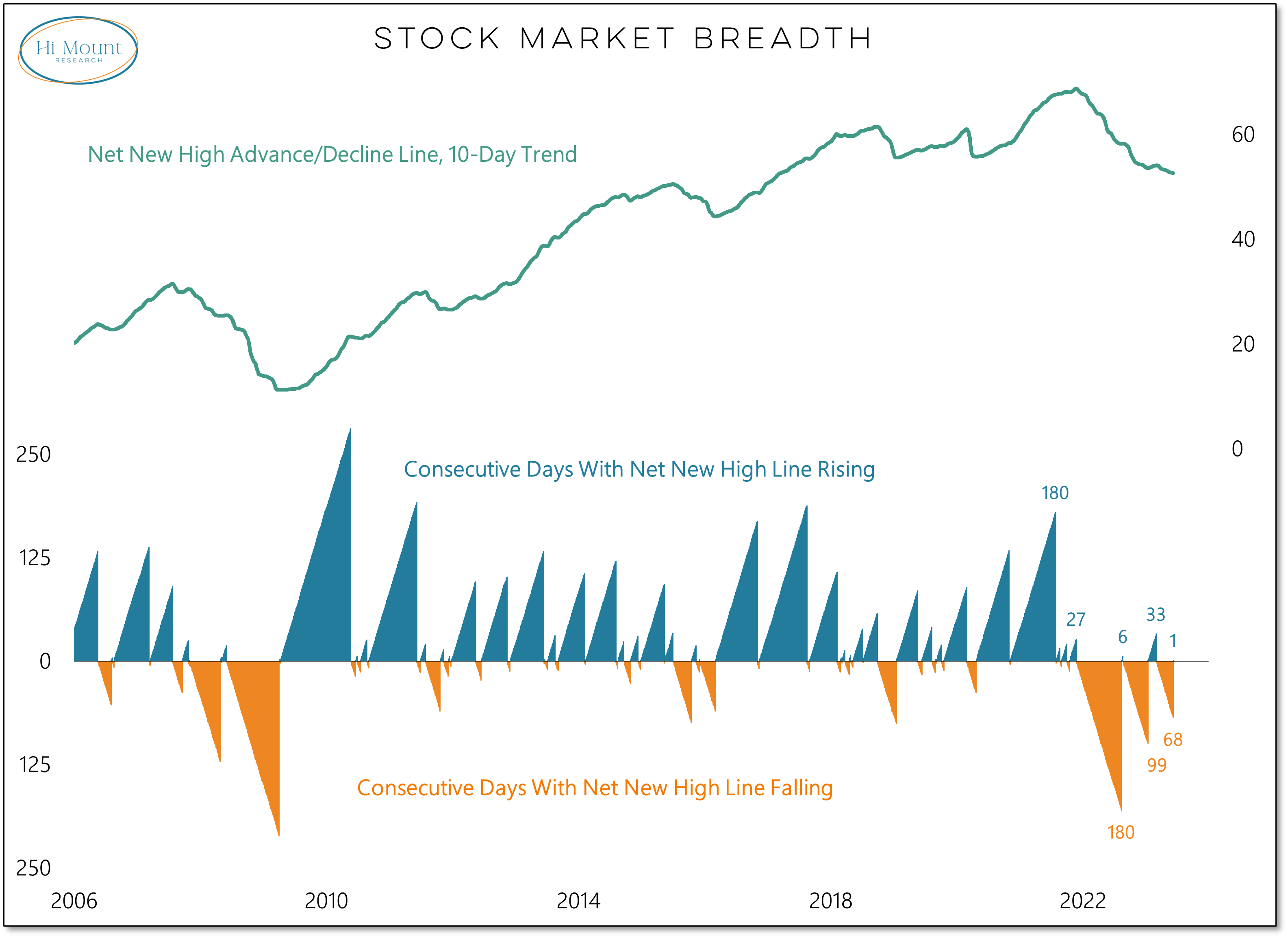

Key Takeaway: Breadth conditions are improving as the trend in net new highs turns higher

More Detail: New highs have exceeded new lows every day this week and the spread has been great enough to turn our Net New High Advance/Decline line higher for the first time in 3+ months. When this happened earlier this year, improvement was short-lived and conditions beneath the surface deteriorated as Q1 rolled into Q2. Sustained strength at this point would represent a more significant turning point between risk and opportunity than the S&P 500 crossing some arbitrary threshold.

Improving breadth + expanding optimism (Bulls Are Ready To Dance) = healthy environment for stocks