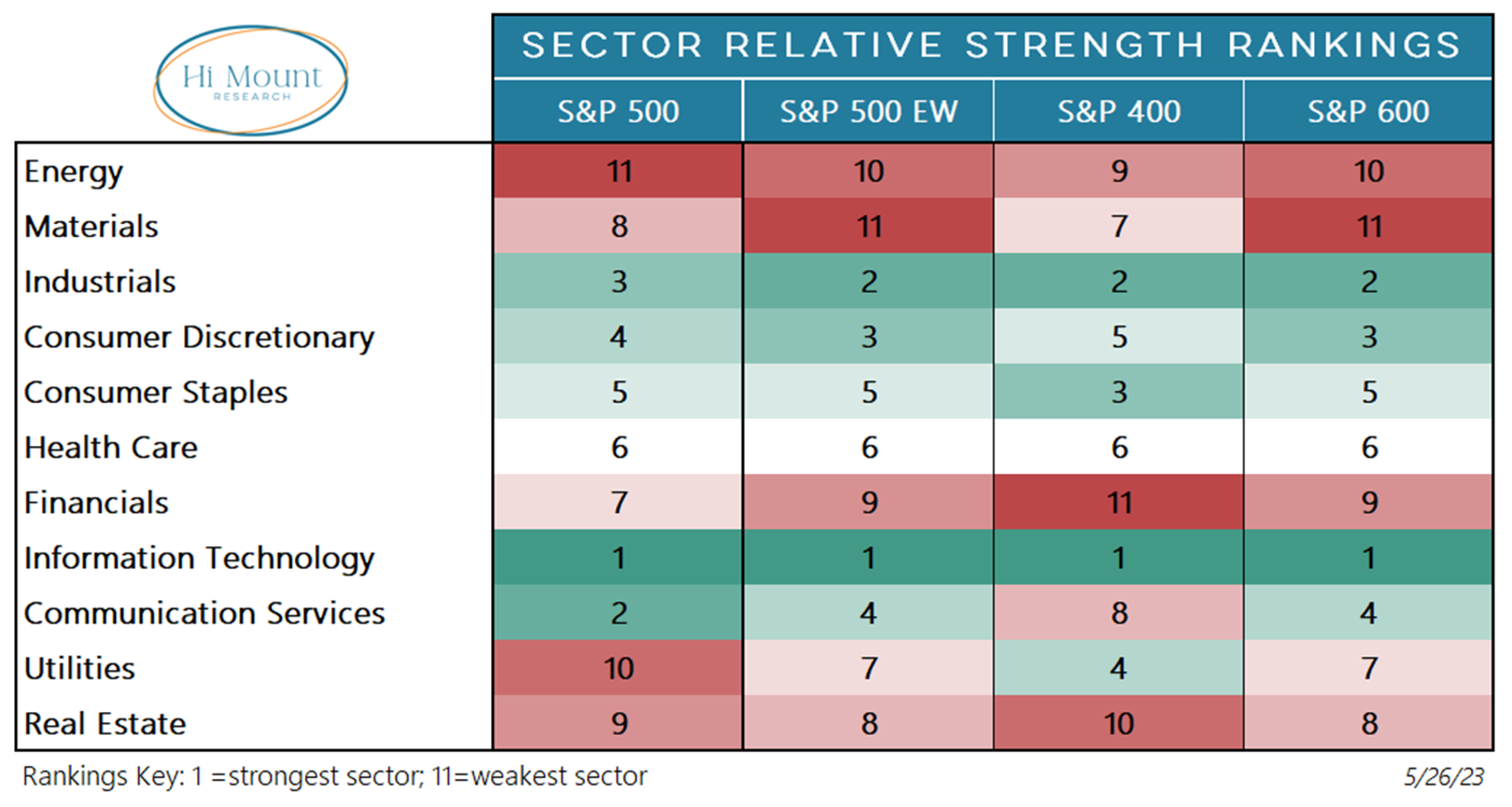

Key Takeaway: Large-cap through small-cap, equal-weight or cap-weight, the story from a relative strength perspective is Technology leadership.

More Context: From a large-cap perspective, Technology at the top of the rankings and the Energy, Utilities, Real Estate and Materials at the bottom of the rankings seems to go a long-way toward explaining divergences between the strength we are seeing in the indexes and the struggles that are evident in the broad market. Technology’s weighting in the S&P 500 is nearly three times that of the four bottom dwellers, combined. It doesn’t assuage concerns about breadth, but Technology sitting atop the S&P 500 equal-weight rankings, as well as those for the small-caps and mid-caps suggests its the sector overall that is a relative leader. On the flip-side, Energy hasn’t been at the bottom of the rankings since late-2020.

For more detail on relative leaders and laggards, within the US and around the world, by index and by ETF, download this week’s Relative Strength Rankings report.